Aditya Birla Capital Limited (ABCL) is the financial services arm of the Aditya Birla Group, a Fortune 500 company. ABCL is a prominent non-banking financial services player in India, offering a diverse range of financial solutions including insurance, asset management, lending, and advisory services. Its focus is on serving retail and corporate clients across various sectors, providing innovative and customized financial solutions.

This blog provides a comprehensive overview of Aditya Birla Capital's history, growth trajectory, and key milestones to help you prepare for interviews.

1. Aditya Birla Capital Overview

About

| Attribute | Details |

|---|---|

| Chairman | Kumar Mangalam Birla |

| Industry Type | Financial Services |

| Founded | 2007 |

| Headquarters | Mumbai, Maharashtra, India |

History

Early Years (2007–2010):

- 2007: Aditya Birla Capital was established as the financial services subsidiary of the Aditya Birla Group.

- 2009: Aditya Birla Sun Life Insurance and Aditya Birla Sun Life Asset Management were integrated under the brand's umbrella, expanding the company’s offerings in life insurance and mutual fund sectors.

Growth and Diversification (2011–2018):

- 2011: The company expanded its product portfolio to include lending services such as personal loans and housing finance.

- 2015: ABCL ventured into health insurance and pension fund management, further diversifying its offerings.

- 2017: The company was listed on the Bombay Stock Exchange and the National Stock Exchange, marking its entry into the public market.

Recent Developments (2019–Present):

- 2019: ABCL strengthened its digital offerings, focusing on digital transformation to enhance customer experience.

- 2021: ABCL continued its strong growth trajectory by enhancing its wealth management and online insurance services.

- 2023: The company remained a key player in the financial services industry, with an emphasis on providing innovative financial solutions to individual and institutional clients.

Key Milestones

| Year | Milestone |

|---|---|

| 2007 | Aditya Birla Capital was founded as the financial services arm of the Aditya Birla Group. |

| 2009 | Integrated life insurance and asset management businesses into its portfolio. |

| 2017 | Listed on the Bombay Stock Exchange and National Stock Exchange. |

| 2019 | Expanded digital transformation initiatives to improve customer experience. |

| 2021 | Strengthened offerings in wealth management and online insurance services. |

2. Company Culture and Values

Vision

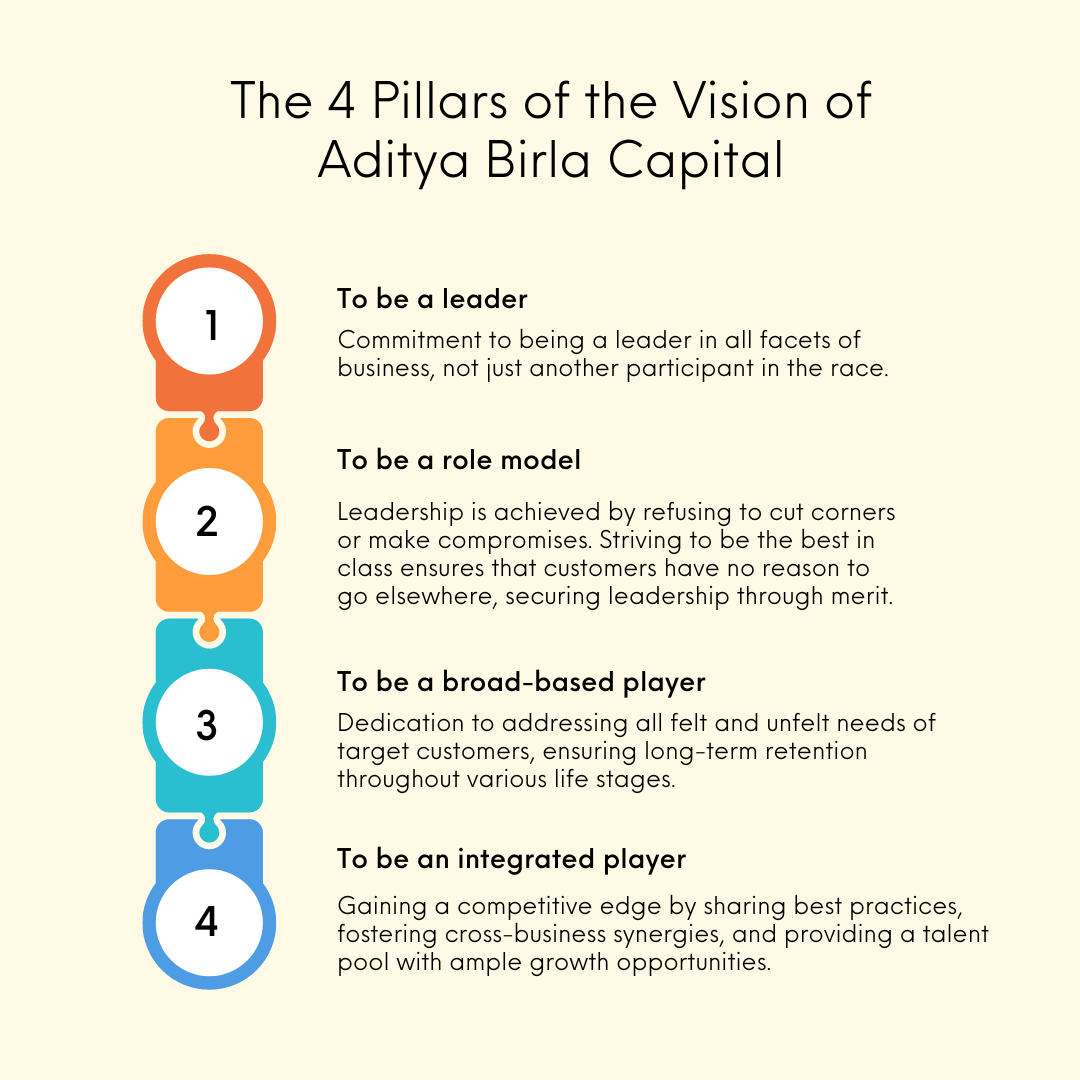

The 4 Pillars of the Vision:

Core Values:

For Customers:

- Becoming the preferred financial services brand for customers across their life cycle, a brand that they not only trust but also happily endorse.

- Offering simplicity and convenience through a unique strategy that unifies all financial service offerings under one brand.

For Employees:

- Providing a world of growth opportunities across all financial services offerings, creating a platform for professional and personal development.

To Shareholders:

- Assurance that customer acquisition and retention are managed cost-effectively across life-cycle needs, with a strategic approach that fosters sustained business growth.

3. Comprehensive Product & Service Offering

Aditya Birla Capital provides a comprehensive suite of financial solutions across various sectors, addressing the diverse needs of individuals and businesses. Here’s a concise overview of their key offerings:

1. Loans

- Home Loans: Offering a range of home financing solutions, including top-up loans and balance transfer options.

- Personal Loans: Collateral-free loans tailored for various needs, including Flexi Loan options for more flexible repayment.

- SME Loans: Financing solutions for small and medium enterprises, including secured and unsecured loans.

2. Insurance

- Life Insurance: Includes term plans, ULIP (Unit Linked Insurance Plans), savings plans, and retirement solutions through Aditya Birla Sun Life Insurance.

- Health Insurance: Comprehensive health and wellness plans, with additional super top-up options for extended coverage.

- Motor Insurance: Car and bike insurance to cover vehicular risks.

3. Investments

- Mutual Funds: A wide variety of funds including debt, equity, hybrid, and index funds under Aditya Birla Sun Life Mutual Fund.

- Stocks and Securities: Services like Demat accounts, equity trading, and portfolio management to help customers grow their wealth.

- Fixed Deposits and Digital Gold: Secure investments with guaranteed returns.

4. Wealth Management

- Tax Solutions: Comprehensive tax planning services to help optimize financial management.

- Portfolio Management Services: Customized solutions to manage large investment portfolios.

This diverse portfolio of products highlights Aditya Birla Capital’s focus on providing holistic financial solutions to meet the evolving needs of its customers across different life stages.

4. Financial Performance Highlights

Aditya Birla Capital Stock Performance:

Aditya Birla Capital's stock performance reflects its strong market presence and investor confidence. Over the past year, the company's stock has shown steady growth, illustrating its resilience and strategic direction within the financial services sector.

Key Financial Indicators:

Analyzing Aditya Birla Capital's financial metrics provides a clear understanding of its financial health and operational efficiency. Key indicators such as revenue growth, profitability margins, and liquidity ratios highlight the company's robust financial framework and its ability to support sustainable growth.

5. Key Competitors of Aditya Birla Capital

Aditya Birla Capital, a subsidiary of the Aditya Birla Group, is a prominent financial services provider in India, offering a wide range of solutions across asset management, insurance, lending, and advisory services. It operates in several segments, including life insurance, health insurance, mutual funds, stockbroking, and more. With a diverse portfolio, it competes with other financial service companies that have a significant presence in the Indian financial market.

Below are some of the key competitors of Aditya Birla Capital:

1. Bajaj Finserv

Overview: Bajaj Finserv is a leading financial services provider in India, offering a broad portfolio including lending, insurance, and wealth management services.

Services: Bajaj Finserv offers personal loans, home loans, business loans, insurance products, and investment services. It also has a strong presence in asset management and wealth advisory services.

Market Position: Bajaj Finserv competes with Aditya Birla Capital in various segments, including lending, insurance, and wealth management. Both companies provide diversified financial solutions for individuals, SMEs, and corporate clients.

2. HDFC Life Insurance

Overview: HDFC Life Insurance is one of the leading life insurance companies in India, offering a wide range of life insurance and pension products.

Services: HDFC Life provides term insurance, ULIPs, pension plans, savings, and investment solutions to individuals and corporate customers.

Market Position: HDFC Life competes with Aditya Birla Capital’s insurance arm, Aditya Birla Sun Life Insurance, especially in the life insurance segment. Both companies have a significant presence in India, offering a comprehensive range of life insurance products and catering to a wide customer base.

3. ICICI Prudential Life Insurance

Overview: ICICI Prudential Life is one of India’s largest private life insurance companies, providing a broad spectrum of insurance products tailored for different life stages and needs.

Services: ICICI Prudential offers products like term plans, ULIPs, retirement plans, and group insurance solutions.

Market Position: ICICI Prudential Life is a direct competitor of Aditya Birla Sun Life Insurance in the life insurance space. Both companies target individuals and corporations, offering a range of life and health insurance products.

4. SBI Life Insurance

Overview: SBI Life Insurance is a joint venture between the State Bank of India and BNP Paribas Cardif, offering a wide range of life insurance products across individual and group segments.

Services: SBI Life offers term insurance, savings and investment plans, ULIPs, and group insurance solutions.

Market Position: SBI Life competes with Aditya Birla Sun Life Insurance in the life insurance market, offering similar products to individuals and corporates, with a significant customer base through SBI’s vast banking network.

5. Kotak Mahindra Bank

Overview: Kotak Mahindra Bank is a prominent financial services conglomerate in India, offering banking and non-banking financial services through its subsidiaries.

Services: Kotak offers life insurance, wealth management, asset management, loans, and banking products through its financial arms.

Market Position: Kotak’s insurance and asset management divisions compete directly with Aditya Birla Capital’s subsidiaries like Aditya Birla Sun Life Insurance and Aditya Birla Sun Life Mutual Fund in insurance, mutual funds, and wealth management services.

6. Corporate Social Responsibility(CSR)

Aditya Birla Capital, through the Aditya Birla Centre for Community Initiatives and Rural Development, focuses on areas such as education, healthcare, sustainable livelihood, and infrastructure development. These efforts are part of the company's mission to enhance the quality of life in underserved communities and promote sustainable development.

7. Leadership Culture at ABC

- Solution-Oriented: Leaders generate new ideas, remain open to others' suggestions, and approach challenges with a solution-first mindset.

- Inspiring: They build empowered teams, fostering mutual respect and driving superior results.

- Passionate Collaborators: Leaders develop strong, sustainable relationships within and outside the organization to achieve shared success.

- Integrity and Ethics: Maintaining high ethical standards and integrity is essential in all actions.

ABC emphasizes both organizational excellence and individual empowerment, making it an ideal environment for motivated professionals to thrive.

8. Future Outlook and Strategic Plans

Aditya Birla Capital is focused on expanding its financial services offerings, enhancing customer experience, and leveraging digital transformation to drive growth. Below are some of Aditya Birla Capital’s key strategic initiatives:

Aditya Birla Capital is investing heavily in digital platforms to provide seamless and secure financial services to customers. The company is focused on enhancing its digital presence through mobile apps, online platforms, and fintech partnerships.

- Expanding digital financial tools to simplify insurance purchasing, mutual fund investments, and wealth management services.

- Collaborating with fintech firms to offer innovative digital solutions such as robo-advisors, AI-driven financial planning, and automated wealth management services.

Aditya Birla Capital aims to enhance its customer experience by offering personalized and tailored financial solutions. The company is focused on developing products that cater to diverse customer segments such as millennials, senior citizens, and high-net-worth individuals (HNWIs).

- Expanding its portfolio to offer customized insurance products, mutual funds, and savings plans for different customer demographics.

- Implementing customer feedback and market research to develop products that align with customer needs and preferences.

Aditya Birla Capital’s insurance division is focusing on expanding its health and life insurance offerings to meet the growing demand for financial protection in India. The company aims to provide innovative and comprehensive coverage solutions.

- Developing new insurance products such as critical illness plans, term insurance, and health insurance riders to cater to specific customer needs.

- Expanding partnerships with hospitals and healthcare providers to offer holistic health insurance solutions.

Aditya Birla Capital is expanding its wealth management and advisory services, focusing on delivering personalized financial solutions to HNWIs and retail investors. The company aims to strengthen its position as a leading wealth management provider.

- Expanding its wealth management services to include financial planning, estate planning, and tax advisory.

- Offering digital platforms that provide clients with real-time insights and personalized investment recommendations.

Aditya Birla Capital is implementing cost-efficiency measures to improve profitability. The company is focused on streamlining operations and optimizing business processes through digital tools and automation.

- Enhancing back-office operations with automated tools to improve efficiency in customer service and financial transactions.

- Implementing cost-saving initiatives to improve operational efficiency without compromising on service quality.

Aditya Birla Capital is committed to promoting sustainable and responsible investing. The company focuses on integrating environmental, social, and governance (ESG) factors into its investment decision-making process.

- Expanding its range of ESG-focused mutual funds and investment products to attract socially-conscious investors.

- Partnering with global financial institutions to promote sustainable finance and ESG practices.

9. Latest News & Updates about Aditya Birla Capital

Stay updated with the latest developments from Aditya Birla Capital, including new financial products, investment solutions, and digital innovations. Discover how Aditya Birla Capital is empowering individuals and businesses with comprehensive financial services, ranging from insurance to wealth management and beyond.

10. Conclusion

Aditya Birla Capital is a leading financial services provider in India, offering a wide range of products and solutions in insurance, wealth management, asset management, and lending. With a focus on customer-centricity, digital transformation, and sustainability, Aditya Birla Capital offers exciting career opportunities across finance, insurance, wealth management, and corporate functions. Aspiring candidates can prepare for a rewarding career at Aditya Birla Capital by aligning their skills with the company’s mission to provide comprehensive and personalized financial solutions to customers.

Key Takeaways for Aspiring Aditya Birla Capital Candidates:

- Research the Company: Understand Aditya Birla Capital’s diverse range of financial services and products, including insurance, wealth management, and mutual funds. Be familiar with the company’s digital initiatives and its leadership in the Indian financial sector.

- Prepare for the Interview Process: For finance and investment roles, focus on your knowledge of financial analysis, risk management, and wealth advisory. For sales and marketing roles, be ready to discuss market strategies and customer engagement.

- Demonstrate Cultural Fit: Aditya Birla Capital values integrity, customer focus, and innovation. Highlight your ability to contribute to the company’s growth by solving real-world financial challenges.

- Stay Informed: Keep up with the latest trends in financial services, including digital transformation, fintech, and sustainable investing. Understanding these trends will help you stand out during the interview process.