Axis Bank, one of India’s largest private sector banks, has established itself as a leader in the banking industry since its inception in 1993. Initially named UTI Bank, it was established as a joint venture between Unit Trust of India (UTI), Life Insurance Corporation of India (LIC), General Insurance Corporation Ltd (GIC), National Insurance Company Ltd. (NIC), and others. The bank provides a wide range of financial products and services, including retail banking, corporate banking, investment banking, and wealth management. Axis Bank is known for its customer-centric approach and technological innovation, making it one of the most preferred banking institutions in India.

This blog offers a detailed overview of Axis Bank’s history, key milestones, and services, providing essential insights for interview preparation.

1. Axis Bank Overview

About

| Attribute | Details |

|---|---|

| Founders | Unit Trust of India (UTI), Life Insurance Corporation of India (LIC), General Insurance Corporation Ltd (GIC), National Insurance Company Ltd. (NIC), and others |

| Industry Type | Banking and Financial Services |

| Founded | 1993 |

| Headquarters | Mumbai, Maharashtra, India |

History

Axis Bank, initially incorporated as UTI Bank Ltd. in 1993, has grown to become one of India's leading private sector banks. Established under the guidance of the Reserve Bank of India (RBI), it has continuously adapted to changing market needs while staying true to its vision of financial inclusion and innovation. Below is the detailed historical breakdown:

Early Years (1993–2000):

- 1993: Incorporated as UTI Bank Ltd.

- 1994: Launched the first branch in Ahmedabad, inaugurated by Dr. Manmohan Singh, Union Finance Minister.

- 1998: Axis Bank's public issue was oversubscribed by 1.2x with over 1 lakh retail investors.

- 1999: Launched its website www.utibank.com, making it one of the early adopters of digital banking in India.

Growth and Global Expansion (2001–2010):

- 2002: Opened the 100th branch at Tuticorin, Tamil Nadu.

- 2004: Offered access to 7,000 ATMs across India, the largest network by any Indian bank at the time.

- 2005: Raised $239.30 million through Global Depositary Receipts (GDRs) in the London Stock Exchange.

- 2007: UTI Bank changes its name to Axis Bank, launches a new logo and a national ad campaign.

- 2009: Appointed Shikha Sharma as MD and CEO of Axis Bank, marking a new leadership era.

Recent Developments (2011–Present):

- 2011: Launched Axis Direct, a retail broking and trading platform.

- 2015: Introduced Burgundy Banking, offering wealth management services to high-net-worth individuals.

- 2016: Issued Asia’s first certified Green Bond by a bank, raising $500 million for green initiatives.

- 2023: Successfully completed the acquisition of Citibank India’s Consumer Business, creating a premier retail franchise.

- 2024: Achieved a significant milestone by opening the 5,000th branch in Ahmedabad.

Key Milestones

| Year | Milestone |

|---|---|

| 1993 | Axis Bank (then UTI Bank Ltd.) was incorporated. |

| 1994 | First branch launched in Ahmedabad. |

| 1998 | Public issue oversubscribed by 1.2x. |

| 2007 | Rebranded from UTI Bank to Axis Bank and launched a new logo. |

| 2011 | Launched retail broking business, Axis Direct. |

| 2015 | Introduced Burgundy Banking for wealth management. |

| 2016 | Issued Asia’s first certified Green Bond by a bank. |

| 2023 | Completed acquisition of Citibank India’s Consumer Business. |

| 2024 | Opened the 5,000th branch in Ahmedabad, Gujarat. |

2. Company Culture and Values

Vision

Mission

Our Mission is to be the preferred financial solutions provider across the country, delivering customer delight by

Purpose

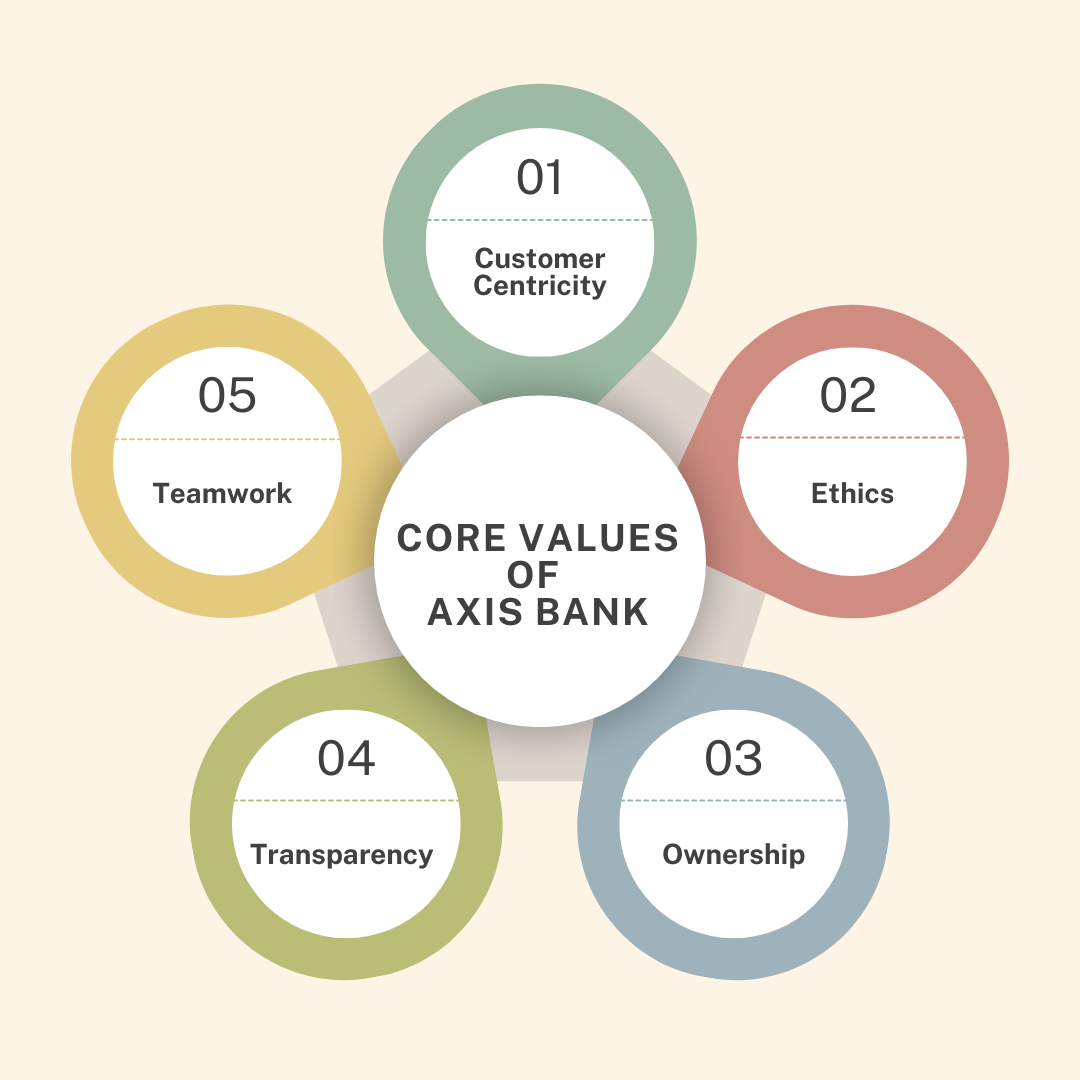

Core Values

3. Comprehensive Product & Service Offering

Axis Bank is renowned for its diverse product and service portfolio, designed to meet the financial needs of individual and corporate clients. Here’s a detailed breakdown of their offerings:

Retail Banking

- Savings Accounts: Provides a variety of savings accounts with competitive interest rates to meet different customer needs.

- Personal Loans: Offers unsecured loans with flexible terms for personal expenses.

- Home Loans: Provides financing solutions for purchasing new homes, with competitive interest rates.

- Credit Cards: A wide range of credit cards offering rewards, cashback, travel benefits, and more.

- Fixed Deposits: Safe investment option with assured returns and flexible tenors.

Corporate Banking

- Business Loans: Tailored financing solutions to support business growth and expansion needs.

- Trade Finance: Comprehensive suite of trade and supply chain finance products to support corporate transactions.

- Cash Management: Customizable solutions for efficient management of corporate cash flows.

- Forex Services: Offers foreign exchange products to manage cross-border trade risk.

Investment & Insurance

- Mutual Funds: Investment opportunities in various mutual fund schemes for wealth creation.

- Life Insurance: Protects the financial future with a range of life insurance products.

- General Insurance: Includes health, motor, travel, and more to safeguard individuals against personal and business risks.

Digital Solutions

- Mobile Banking: Provides banking services on the go through a user-friendly app.

- Internet Banking: Secure online banking platform for seamless bill payments and transactions.

- UPI Services: Instant payment solutions via Unified Payments Interface for personal and business uses.

With its comprehensive range of products and services, Axis Bank ensures financial empowerment for a broad spectrum of customers, staying committed to fostering an inclusive financial ecosystem.

4. Financial Performance Highlights

Axis Bank Stock Performance:

Axis Bank's stock performance is a testament to its robust financial picture and dynamic market strategy. The chart below provides insight into the stock's fluctuations over the past year, reflecting both the challenges and opportunities faced by the bank in the competitive financial services sector.

Key Financial Indicators:

Analyzing the financial fundamentals of Axis Bank provides investors and stakeholders with a detailed view of its economic health and future prospects. The table below encapsulates critical financial indicators, highlighting the bank's financial stability through ratios concerning liquidity, profitability, and leverage over recent fiscal years.

5. Key Competitors of Axis Bank

Axis Bank offers a wide range of banking and financial services to individuals, corporates, SMEs, and institutional clients. It competes in various segments such as retail banking, corporate banking, credit cards, loans, insurance, and wealth management. The financial services sector in India is highly competitive, with several major players vying for market share. Below are the key competitors of Axis Bank.

1. State Bank of India (SBI)

Overview: SBI is the largest public sector bank in India, with a significant market share in retail and corporate banking. SBI also has an extensive international presence.

Services: SBI provides a wide range of services, including personal loans, home loans, SME loans, insurance, mutual funds, corporate banking, and investment banking.

Market Position: SBI competes with Axis Bank in both retail and corporate banking. While SBI has a larger branch network, especially in rural areas, Axis Bank focuses more on innovation and personalized services for urban and semi-urban markets.

2. HDFC Bank

Overview: HDFC Bank is India’s largest private sector bank by assets and market capitalization. It has a well-established presence across India with a focus on both retail and corporate banking services.

Services: HDFC Bank offers a wide range of services, including personal loans, home loans, credit cards, corporate banking, wealth management, and investment banking.

Market Position: HDFC Bank is a direct competitor to Axis Bank in the retail banking segment, particularly in personal loans, home loans, and credit cards. HDFC Bank’s strong technology adoption and customer-centric services have made it a leading player in the Indian banking industry.

3. ICICI Bank

Overview: ICICI Bank is one of the largest private sector banks in India, providing banking, insurance, and investment services. It has a strong presence both in India and internationally.

Services: ICICI Bank provides personal loans, home loans, credit cards, SME banking, corporate banking, and investment solutions through its subsidiaries like ICICI Lombard and ICICI Prudential.

Market Position: ICICI Bank competes with Axis Bank across multiple banking and financial service sectors, particularly in retail banking, credit cards, and corporate banking. Both banks focus on providing digital banking solutions to enhance customer experience.

4. Kotak Mahindra Bank

Overview: Kotak Mahindra Bank is a leading private sector bank in India, offering a wide range of banking and financial services, including loans, insurance, and investment products.

Services: Kotak provides personal loans, home loans, credit cards, wealth management, insurance, and corporate banking services, with a focus on affluent customers and businesses.

Market Position: Kotak Mahindra Bank competes with Axis Bank in the retail banking, wealth management, and corporate banking segments. Both banks are known for their focus on digital banking platforms and providing tailored financial services.

5. Yes Bank

Overview: Yes Bank is a private sector bank offering a wide range of banking and financial services. It focuses on corporate and SME banking, retail banking, and investment services.

Services: Yes Bank provides personal loans, SME loans, home loans, credit cards, corporate banking, and wealth management services.

Market Position: Yes Bank competes with Axis Bank in the retail and corporate banking sectors. While Yes Bank has been restructuring after recent financial challenges, it continues to compete with Axis Bank in retail and SME banking, offering similar products and services.

6. Corporate Social Responsibility (CSR)

Axis Bank's CSR strategy focuses on creating an inclusive and equitable economy, thriving communities, and a healthier planet. The bank has a robust Environmental, Social, and Governance (ESG) framework that guides its CSR efforts, aimed at financial inclusion, education, sustainable livelihoods, and environmental sustainability.

7. Life at Axis Bank

Axis Bank emphasizes a holistic, value-driven approach to work, focusing on diversity, inclusion, and employee wellbeing.

Diversity, Equity, and Inclusion:

- Aiming for 30% women workforce by 2025.

- #ComeAsYouAre policies supporting LGBTQIA+ employees with inclusive practices and dedicated in-house support groups.

- Ensures biases are addressed from recruitment to exit.

Employee Health and Wellbeing at Axis Bank

Axis Bank prioritizes the health and wellbeing of its employees through various initiatives, including:

- Health Webinars: Regular sessions with medical professionals to educate employees on health issues, including COVID-19 and chronic illnesses.

- Counselor On-Board: In-house professionals offer confidential support for personal wellbeing concerns.

- Seven Up: Encourages employees to maintain a healthy work-life balance by winding up work by 7 PM.

- Weekend Your Way: Supports employees in using their time off for recreational activities.

- Silent Hour: Provides a mid-day break for a peaceful lunch.

Open to Listening

Axis Bank values open communication and regularly conducts surveys to gauge employee concerns and feedback. This helps shape the company’s people strategy and address real-time issues. Employees are encouraged to share ideas and opinions, making the feedback process an integral part of decision-making.

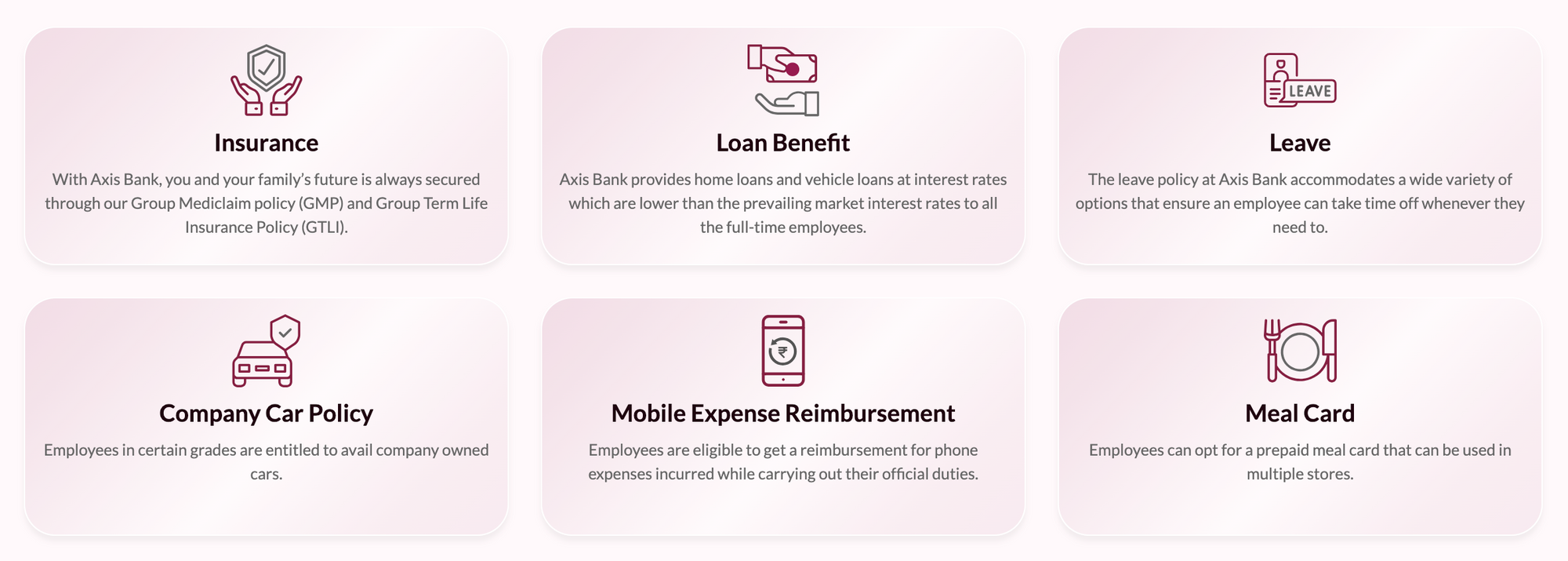

8. Perks & Benefits at Axis Bank

Axis Bank offers a variety of employee benefits, including comprehensive insurance coverage, special loan benefits with lower interest rates, a flexible leave policy, and mobile expense reimbursements. Employees may also access company car policies and meal cards, ensuring support for both personal and professional needs.

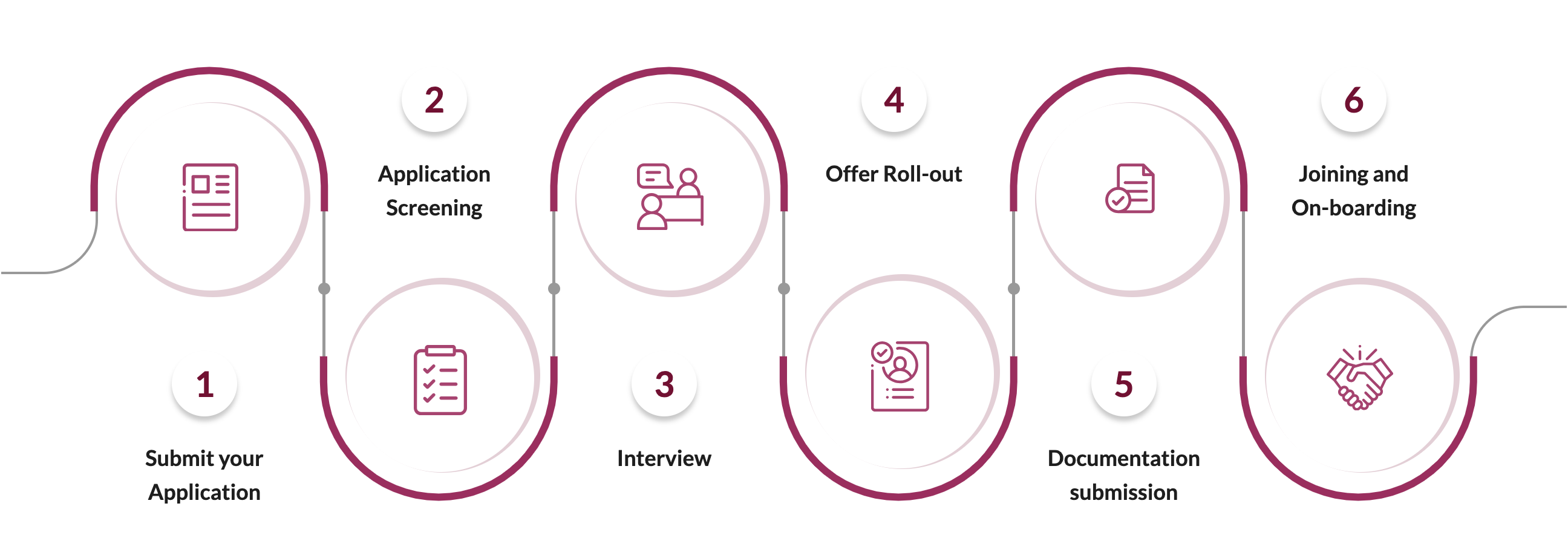

9. Hiring Process at Axis Bank

Axis Bank is an equal-opportunity workplace that brings together people from diverse backgrounds and gives each person the right opportunity and environment to perform to the best of their abilities.

10. Campus Programs for leaders of tomorrow

Axis Bank offers a range of programs designed to cultivate future leaders across various domains:

AHEAD: A flagship program for young leaders from Tier 1 B-schools, extending to both interns and management trainees from these campuses.

Aspire: Targets management graduates from specific campuses, including new IIMs and IITs, for niche hiring in key departments to build a strong talent pipeline.

ABLe: A cadre program for recruiting post-graduates (MBA/PGDM/MMS) from Tier 2 B-schools.

WeLead: A diversity hiring program that focuses on women management graduates from Tier 1 B-schools, offering middle-management roles.

ARISE: Open to all undergraduates and postgraduates, this program allows direct applications for management trainee roles without campus recruitment.

11. Future Outlook and Strategic Plans

Axis Bank is focused on expanding its digital banking services, enhancing customer experience, and increasing its market share across retail and corporate banking. Below are some of Axis Bank’s key strategic initiatives:

1. Expansion of Digital Banking Solutions

Axis Bank is investing heavily in digital platforms to provide seamless and secure banking services. The bank is focused on offering personalized and convenient digital banking solutions for retail and corporate customers.

- Expanding digital products, including Axis Mobile and internet banking platforms, to provide comprehensive financial services.

- Collaborating with fintech companies to offer innovative digital banking solutions and improve the customer experience.

2. Focus on Customer-Centric Products

Axis Bank aims to enhance customer experience by offering a diverse range of banking products tailored to different customer segments. The bank is focusing on expanding its offerings in retail banking, insurance, and investment services.

- Developing customer-centric financial products, including savings accounts, loans, and investment products, to meet the diverse needs of individuals and businesses.

- Strengthening its customer service model through personalized banking experiences and omnichannel support.

3. Growth in SME and Corporate Banking

Axis Bank is focused on expanding its corporate and SME banking portfolio, providing financial services to a wide range of businesses, from small enterprises to large corporations.

- Expanding corporate banking services such as credit facilities, trade finance, and working capital loans to support business growth.

- Developing specialized financial products for SMEs to promote entrepreneurship and support small business owners.

4. Sustainability and Green Finance Initiatives

Axis Bank is committed to promoting sustainable finance by offering green finance products and supporting environmentally friendly projects. The bank focuses on sustainability as a core part of its corporate strategy.

- Expanding its green financing solutions, including loans for renewable energy projects and environmentally sustainable infrastructure.

- Implementing eco-friendly practices across the bank’s operations, reducing its carbon footprint, and promoting responsible business conduct.

5. Operational Efficiency and Cost Optimization

Axis Bank is implementing cost optimization strategies to improve profitability and operational efficiency. The bank is focusing on streamlining its internal processes through automation and digital tools.

- Enhancing back-office operations through automation to improve efficiency and reduce processing times for customer transactions.

- Implementing cost-saving initiatives across business operations to maintain competitiveness and profitability.

6. Focus on Financial Inclusion and Rural Banking

Axis Bank is expanding its financial inclusion programs by offering banking services to underserved rural areas. The bank aims to reach more individuals through microfinance, digital banking, and affordable banking products.

- Strengthening financial inclusion initiatives by expanding branch networks and digital banking solutions in rural areas.

- Offering microfinance solutions and low-cost financial products to promote financial literacy and inclusion among low-income households.

12. Latest News & Updates about Axis Bank

Stay updated with the latest news from Axis Bank, including new banking products, digital banking innovations, and strategic partnerships. Learn how Axis Bank is enhancing customer experiences and shaping the future of financial services with its wide range of banking solutions and technological advancements.

13. Conclusion

Axis Bank is a leading player in the Indian banking sector, offering a wide range of financial products and services to individuals, SMEs, and corporate clients. With a strong focus on digital transformation, customer-centric solutions, and sustainable finance, Axis Bank offers exciting career opportunities across various domains such as retail banking, corporate banking, IT, risk management, and operations. Aspiring candidates can prepare for a rewarding career at Axis Bank by aligning their skills with the company’s vision to drive growth through innovation and customer satisfaction.

Key Takeaways for Aspiring Axis Bank Candidates:

- Research the Company: Understand Axis Bank’s core business areas, including retail and corporate banking, wealth management, and digital banking. Be familiar with its customer-centric approach and its role as one of India’s leading private-sector banks.

- Prepare for the Interview Process: For finance, banking operations, and IT roles, focus on your knowledge of banking products, regulations, and digital banking technologies. For sales and marketing roles, be ready to discuss customer engagement strategies and product promotion.

- Demonstrate Cultural Fit: Axis Bank values integrity, customer service, and innovation. Highlight your leadership, teamwork, and problem-solving skills in alignment with these values.

- Stay Informed: Keep up with the latest trends in the banking industry, including digital transformation, fintech, and regulatory changes. Understanding these trends will help you stand out during the interview process.