HDFC Bank: A Leader in India's Private Sector Banking Industry

HDFC Bank Limited, headquartered in Mumbai, India, is one of the largest private-sector banks in the country. It was incorporated in August 1994 and commenced operations as a scheduled commercial bank in January 1995. The bank was established by the Housing Development Finance Corporation (HDFC) and received the first 'in-principle' approval from the Reserve Bank of India to set up a private sector bank during the liberalization of the Indian banking industry.

This blog is designed to provide aspiring candidates with a comprehensive overview of HDFC Bank, covering its history, culture, services, and career opportunities, to help you prepare effectively for interviews and embark on a successful career with this esteemed institution.

1. Overview of HDFC Bank

About

History

Foundation and Early Years (1994-1999)

- 1994: HDFC Bank was incorporated in August as HDFC Bank Limited, following the Housing Development Finance Corporation's (HDFC) approval from the Reserve Bank of India (RBI) to set up a private sector bank.

- 1995: The bank commenced operations in January. It opened its first corporate office and branch in Mumbai. In March, HDFC Bank launched its IPO, which was oversubscribed by 55 times, and it got listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) later that year.

- 1997: The bank declared its maiden dividend of 8% on equity shares, reflecting its growing financial stability.

- 1999: HDFC Bank launched India's first international debit card and introduced online real-time NetBanking, marking the beginning of its digital banking journey.

Expansion and Innovation (2000-2010)

- 2000-2001: HDFC Bank became the first private bank authorized to collect income tax for the Indian government. It also listed on the New York Stock Exchange (NYSE) in 2001.

- 2006: The bank merged with Centurion Bank of Punjab, significantly expanding its branch network and customer base.

- 2008: HDFC Bank launched its first mobile banking services, enhancing customer convenience.

Recent Developments (2011-Present)

- 2015: Aditya Puri, the bank's long-serving CEO, announced plans for digital transformation, emphasizing technology integration in banking services.

- 2020: HDFC Bank launched several initiatives under its "Parivartan" program, focusing on social responsibility and community empowerment.

- 2021: The bank continued to innovate in digital banking, introducing new features and services to enhance customer experience.

- 2022: HDFC Bank expanded its reach with over 5,430 branches and 15,292 ATMs across India, maintaining its position as a leading private bank.

- 2023: Following the retirement of Aditya Puri, Sashidhar Jagdishan took over as CEO, promising to uphold the bank's legacy and drive further growth.

Throughout its history, HDFC Bank has demonstrated consistent growth, achieving a compounded annual growth rate (CAGR) of 30% since its IPO. It has become a significant player in the Indian banking sector, focusing on customer-centric services and technological advancements to meet evolving market demands.

Key Milestones in HDFC Bank’s History

2. Company Philosophy and Culture

Mission

The bank is committed to maintaining the highest level of ethical standards, professional integrity, corporate governance, and regulatory compliance.

Objectives

The bank has a two-fold objective:

2. To achieve healthy growth in profitability, consistent with the bank’s risk appetite.

Core Values

HDFC Bank’s business philosophy is based on five core values:

Culture

At HDFC Bank, the organization's culture and people serve as pivotal enablers in consistently creating value for its stakeholders. The bank has embarked on a deliberate Culture Transformation journey known as "The HDFC Bank Way." This initiative reflects HDFC Bank's commitment to fostering a positive and dynamic work environment that aligns with its core values and long-term goals.

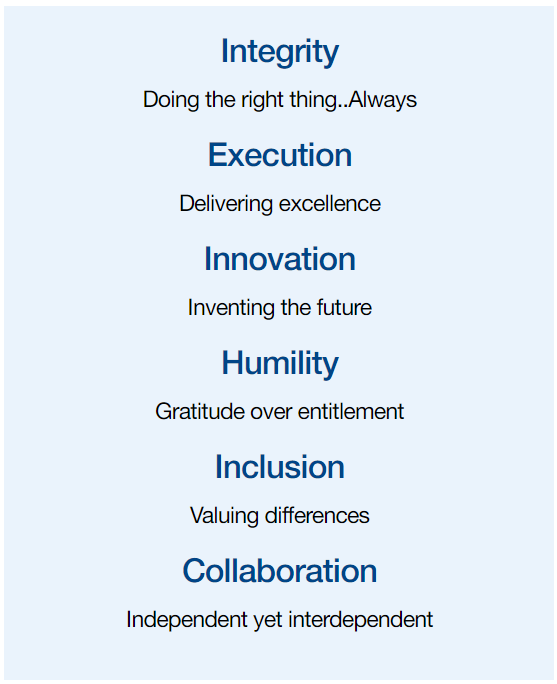

The HDFC Bank Way is defined by the six pillars of culture:

3. Comprehensive Product and Service Offerings at HDFC Bank

HDFC Bank offers a comprehensive range of products and services across various business segments. Below is a detailed list based on the provided source:

Retail Banking

HDFC Bank's Retail Banking segment targets individuals, salaried professionals, micro and small businesses, and Non-Resident Indians (NRIs). Key products and services include:

- Personal Loans

- Auto Loans

- Home Loans/Mortgages

- Wealth Management Services for High Networth Individuals (HNI)

- Payments Solutions (including digital wallets and payment gateways)

Home Loan/Mortgages Business

Following its merger with HDFC Limited, the bank provides a wide array of housing loans tailored to various customer needs, including:

- Loans for Individual Borrowers

- Loans for Salaried Persons

- Loans for Self-Employed Professionals

Wholesale/Corporate Banking

This segment caters to large corporates, Public Sector Undertakings (PSUs), government entities, and multinational corporations. Services include:

- Working Capital Finance

- Trade Services

- Transactional Services

- Cash Management Solutions

- Structured Solutions combining cash management with vendor and distributor finance

- Investment Banking Services, including:

- Debt Capital Markets

- Equity Capital Markets

- Rupee Loan Syndication

- Advisory Services

Commercial and Rural Banking (CRB)

Established as a growth engine, this segment focuses on Micro, Small, and Medium Enterprises (MSMEs) and rural customers. Key offerings include:

- Healthcare Finance

- Equipment Finance

- Commercial Transport Financing

- Agricultural Financing

Treasury

The Treasury manages the bank’s cash and liquid assets, focusing on:

- Investment Management in securities and market instruments

- Liquidity and Interest Rate Risk Management

- Foreign Exchange and Interest Rate Risk Management Services for customers

These segments and their respective products and services reflect HDFC Bank's commitment to catering to diverse customer needs across retail, corporate, and rural banking sectors.

4. Financial Performance and Market Position

HDFC Bank Stock's Performance

Financial Metrics:

5. Key Competitors

HDFC Bank's top competitors are the other large private sector banks in India, with ICICI Bank being the closest competitor, followed by Axis Bank and Kotak Mahindra Bank. The merger with HDFC Ltd has also significantly increased HDFC Bank's size and market share. Following are the key competitors of HDFC Bank

1. ICICI Bank

Overview

ICICI Bank, established in 1994 and headquartered in Mumbai, is one of India's leading private sector banks.

Services

- Retail Banking: Personal, auto, and home loans; credit cards; wealth management.

- Corporate Banking: Working capital finance, trade services, cash management.

- International Banking: Operations in multiple countries.

- Digital Services: iMobile Pay app and InstaBIZ for MSMEs.

Market Position

ICICI Bank has a market share of about 5.9% and operates over 6,500 branches and 17,000 ATMs across India.

2. Axis Bank

Overview

Axis Bank, founded in 1994 and headquartered in Mumbai, is a major player in retail and corporate banking.

Services

- Retail Banking: Savings accounts, personal and home loans, credit cards.

- Corporate Banking: Working capital finance and trade finance.

- Wealth Management: Investment advisory and insurance products.

- Digital Banking: Robust digital platform for banking services.

Market Position

Axis Bank is one of the top private banks in India, focusing on enhancing its digital capabilities.

3. Kotak Mahindra Bank

Overview

Kotak Mahindra Bank, founded in 1985 and headquartered in Mumbai, is a prominent private sector bank.

Services

- Retail Banking: Personal, home, and auto loans; savings accounts.

- Corporate Banking: Working capital finance and investment banking.

- Wealth Management: Financial advisory and portfolio management.

- Insurance and Mutual Funds: Products through subsidiaries.

Market Position

Kotak Mahindra Bank has a strong financial performance and a growing market share.

4. State Bank of India (SBI)

Overview

SBI, founded in 1806 and headquartered in Mumbai, is the largest bank in India.

Services

- Retail Banking: Savings accounts, personal loans, and credit cards.

- Corporate Banking: Comprehensive solutions for large corporations.

- International Banking: Extensive global presence.

- Digital Banking: SBI YONO app for integrated services.

Market Position

SBI holds a commanding market share and is recognized as a "Domestic Systemically Important Bank" with a vast branch network.

5. Punjab National Bank (PNB)

Overview

PNB, founded in 1894 and headquartered in New Delhi, is one of the oldest and largest public sector banks in India.

Services

- Retail Banking: Savings accounts, personal loans, credit cards, and wealth management.

- Corporate Banking: Working capital finance, trade services, and cash management.

- Digital Banking: PNB One app for integrated banking services.

Market Position

PNB has a significant presence in northern and central India, with over 10,000 branches and 13,000 ATMs.

6. Corporate Social Responsibility (CSR)

HDFC Bank's social initiative, Parivartan, has significantly impacted millions across India, focusing on economic and social development. Through a variety of programs, Parivartan has empowered communities in rural areas, improved access to education, supported social start-ups, and promoted financial independence through sustainable livelihood initiatives. The initiative continues to drive change, staying true to the bank's commitment to sustainability and innovation.

Under Parivartan, HDFC Bank works on the following focus areas