HSBC, one of the world’s largest banking and financial services organizations, has been a cornerstone of global finance for over 150 years. With operations in more than 60 countries and a customer base exceeding 40 million, HSBC plays a crucial role in facilitating international trade, investment, and economic development. Founded in 1865, the bank has evolved from its origins in Hong Kong to become a global financial powerhouse headquartered in London.

This blog is designed to provide aspiring candidates with a comprehensive overview of HSBC, covering its history, culture, services, and career opportunities, to help you prepare effectively for interviews and embark on a successful career with this esteemed institution.

1. Overview of HSBC

About

| Attribute | Details |

|---|---|

| Founder | Thomas Sutherland |

| Industry Type | Banking and Financial services |

| Founded | 1865 |

| Headquarters | London, United Kingdom |

History and Founding Years:

The bank was established to facilitate trade between Europe and Asia, particularly in the opium trade. Today, HSBC operates in over 60 countries and serves more than 40 million customers globally.

Founding and Early Years (1865–1900):

- 1865: HSBC was founded in Hong Kong to finance the growing trade between Europe and Asia.

- 1875: Opened its first London office, marking its expansion into Europe.

- 1880: Expanded further into Asia, establishing a strong presence in China and Japan.

- 1900: HSBC became a key player in financing international trade, especially in Asia.

Growth and Global Expansion (1900–1950):

- 1910: Expanded its operations in the United States and Latin America.

- 1923: Became the first bank in Asia to introduce safe deposit boxes.

- 1941: Suffered major losses during World War II, especially in Asia, but continued to operate.

- 1950: Recovered post-war and expanded its international presence, especially in Europe and the Americas.

Modern Era and Strategic Acquisitions (1950–2000):

- 1959: Acquired The British Bank of the Middle East and The Mercantile Bank of India, strengthening its position in the Middle East and India.

- 1992: Merged with Midland Bank in the UK, establishing a strong foothold in Europe.

- 1999: Launched HSBC Direct, an online banking service, pioneering digital banking.

Recent Developments (2000–Present):

- 2002: Shifted its headquarters to London, becoming a UK-based global banking giant.

- 2008: Played a key role during the global financial crisis, maintaining stability and acquiring troubled assets.

- 2020: Announced a major restructuring to focus on Asia and reduce its European and American operations.

Key Milestones in HSBC's History

| Year | Milestone |

|---|---|

| 1865 | Founded in Hong Kong to finance trade between Europe and Asia. |

| 1875 | Opened its first office in London, expanding into Europe. |

| 1992 | Acquired Midland Bank, establishing a major presence in the UK. |

| 1999 | Launched HSBC Direct, a pioneer in online banking. |

| 2008 | Successfully navigated the global financial crisis, acquiring significant assets. |

| 2020 | Announced a strategic focus on Asia, reflecting its roots and growth potential in the region. |

| 2023 | Strengthened its digital banking services, focusing on innovation and customer experience. |

2. Company Culture and Values

Mission, Vision, and Values

HSBC's mission, vision, and values reflect its commitment to being a leading international bank while fostering an inclusive and responsible banking environment.

HSBC's mission is encapsulated in the phrase "Opening up a world of opportunity." This purpose emphasizes the bank's role in using its expertise and resources to create new opportunities for its customers, communities, and stakeholders.

HSBC aspires to be the leading financial partner globally, focusing on supporting cross-border banking and leveraging its international network to maintain leadership in key markets.

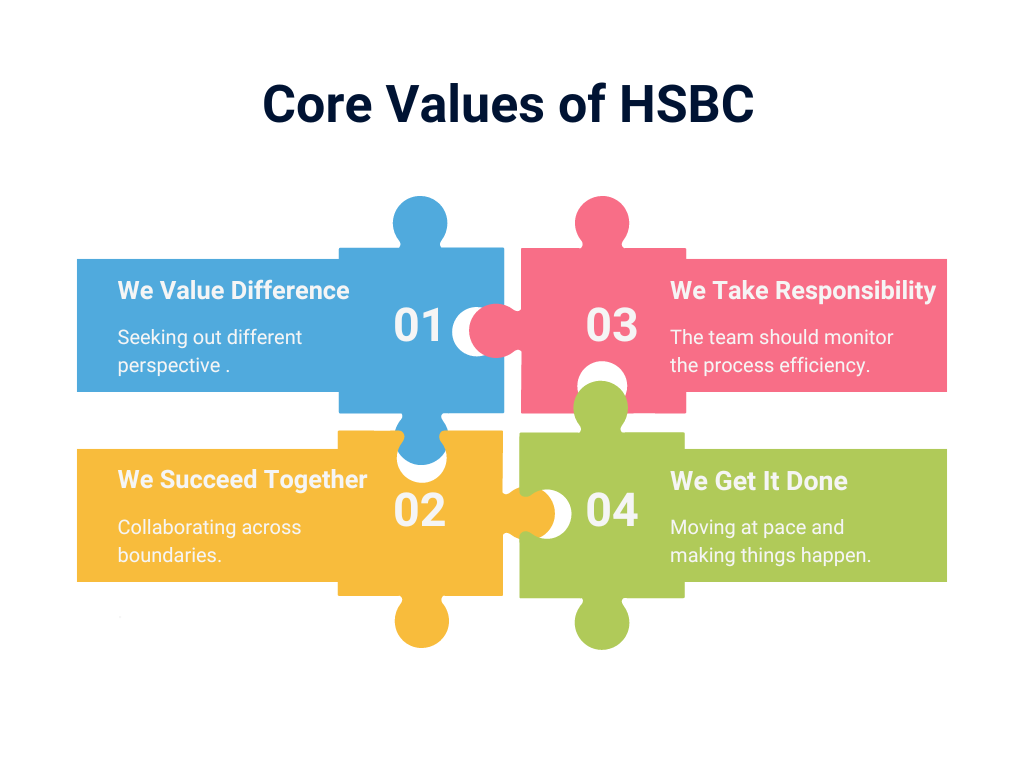

HSBC's values guide its operations and interactions. They are:

These principles collectively aim to create a banking environment that not only meets the financial needs of customers but also contributes to broader societal goals.

3. Comprehensive Product and Service Offerings at HSBC

HSBC offers a wide range of banking products and services to cater to the diverse needs of its customers. Here are some key offerings from the bank's official website

Corporate Banking

- Working capital facilities such as domestic and international trade operations and funding

- Channel financing and overdrafts

- Domestic and international payments

- INR term loans (including external commercial borrowings in foreign currency)

- Letters of guarantee

- Cash management, treasury, trade, and factoring support

Personal Banking

- Savings accounts with features like personalized checkbooks, international debit cards, and online banking

- Home loans, smart home, loan against property (LAP), and smart loan against property (SmartLAP)

- Personal loans and credit cards

- SmartMoney account combining savings account and fixed deposits

Global Private Banking

- Comprehensive wealth solutions including mutual funds, alternative investment funds, bonds, and structured products

- Tailored lending services like home loans, loans against property, and loans against shares

- International services like global private banking status, assistance in opening accounts overseas, and preferential foreign exchange rates

- Exclusive benefits and experiences through the HSBC Global Private Banking Visa Infinite Debit Card

Global Markets

- Payments and foreign exchange solutions

- AI-powered digital services for institutional investors

- Commodities trading leveraging HSBC's expertise in precious metals

- Credit solutions through strategically located dealing rooms

- Rates products for debt issuance, financing, risk management, and investments

- Equities trading, sales, distribution, structured equity and equities finance

- FX algorithms and intermediary services

- Derivatives clearing services

4. Financial Performance and Market Position

HDFC Bank Stock Performance

The chart below illustrates HSBC’s stock performance over the past year, reflecting its resilience and strategic initiatives. With a positive yield of +14.39% for the period, HSBC demonstrates strong financial health, driven by its focus on sustainable growth, digital innovation, and expanding its presence in key markets like Asia.

HSBC's Financial Metrics Table

The table below provides an overview of HSBC's key financial metrics across recent quarters, including Net Profit Margin, Return on Equity (ROE), and Debt to Equity Ratio. These metrics offer a concise look at HSBC's financial performance, helping to assess its profitability, leverage, and overall financial health.

HSBC is positioned as one of the largest and most influential banking institutions globally, leveraging its extensive international presence and diverse service offerings. Here’s an overview of its industry positioning and competitors

5. Industry Positioning and Competitors

Industry Positioning

- Global Reach: HSBC operates in over 62 countries and territories, serving approximately 39 million customers. This extensive network enables the bank to facilitate international trade and investment, making it a key player in global banking and financial services.

- Market Leadership: As of December 2023, HSBC is the largest Europe-based bank by total assets, with approximately $2.919 trillion. It ranks 20th in the world among large companies based on sales, profits, assets, and market value. The bank's dual primary listings on the Hong Kong and London Stock Exchanges further solidify its stature in the financial sector.

- Comprehensive Services: HSBC offers a wide range of financial products across three main business groups: Commercial Banking, Global Banking and Markets, and Wealth and Personal Banking. This diversity allows HSBC to cater to various customer segments, from individual consumers to large corporations and governments.

Competitors of HSBC Bank

HSBC faces competition from several major banks and financial institutions, including:

- JPMorgan Chase: A leading global financial services firm, JPMorgan Chase offers a wide array of investment banking, financial services, and asset management solutions, competing directly with HSBC in the corporate and investment banking sectors.

- Citigroup: Another major competitor, Citigroup provides a broad range of financial services, including retail banking, credit cards, and investment banking, with a strong international presence similar to HSBC.

- Standard Chartered: This bank focuses on emerging markets and has a significant footprint in Asia, Africa, and the Middle East, positioning it as a direct competitor in many of the same markets where HSBC operates.

- BNP Paribas: As the largest bank in Europe by market capitalization, BNP Paribas competes with HSBC in various segments, including corporate banking and investment services.

- Deutsche Bank: This German bank provides a range of financial services and competes with HSBC in investment banking and asset management.

HSBC's ability to navigate the competitive landscape is enhanced by its commitment to innovation, sustainability, and a customer-centric approach, which are crucial in maintaining its market position amidst evolving financial dynamics.

6. Corporate Social Responsibility (CSR)

HSBC is committed to being a responsible business that supports sustainable economic growth and helps communities thrive. The bank's corporate social responsibility (CSR) efforts focus on the following key areas: