Maveric Systems: Pioneering Digital Transformation in Banking Technology and Growth Opportunities

Maveric Systems, founded in 2000, is a specialized BankTech consulting firm focused on digital transformation for global banks and financial institutions. With over 2,600 technology specialists, the company offers services including digital, data, core banking, and quality engineering solutions. Its expertise spans across retail, corporate, and wealth management sectors, helping clients navigate challenges through the integration of emerging technologies and proven frameworks. The firm operates in 15 countries and is recognized for its customer-centric delivery model, emphasizing deep domain knowledge and a commitment to client success.

This blog aims to give aspiring candidates a thorough understanding of Maveric Systems, exploring its history, culture, services, and career opportunities. Whether you're preparing for interviews or looking to build a successful career with this renowned institution, you'll find the insights you need here.

1. Overview of Maveric Systems

About

| Attribute | Details |

|---|---|

| Founder | Ranga Reddy, P Venkatesh, NN Subramanian, VN Mahesh |

| Industry Type | Information Technology |

| Founded | 200 |

| Headquarters | Chennai, India |

Company History

Founding Year (2000):

- Maveric Systems established as a niche, domain-led BankTech consulting firm focused on providing technology solutions for global banks.

- Aimed to address unique challenges in the banking sector through specialized services.

Early Growth and Establishment (2001-2010):

- Built a strong foundation in banking technology with expertise in core banking, quality engineering, and digital transformation.

- Established partnerships with various banks, enhancing reputation as a trusted advisor.

Diversification and Expansion(2011-2015):

- Expanded service offerings to include data analytics and digital solutions for retail, corporate, and wealth management sectors.

- Increased global presence by establishing delivery centers in multiple countries.

Recognition and Scaling Up (2016-2019):

- Recognized among the fastest-growing technology organizations, featured in Deloitte’s Technology Fast 50.

- Scaled team to over 2,000 members, strengthened position as a domain-led transformation specialist.

- Earned trust of leading global banks and fintech companies.

Technological Advancements and New Offerings (2020-2022)

- Introduced innovative platforms and frameworks to enhance digital transformation initiatives.

- Focused on quality engineering and automation, further solidifying reputation in the banking sector.

Recent Developments

- Continues to innovate and expand offerings, aiming to be among the top three niche BankTech specialists.

- Emphasizes customer intimacy and deep domain expertise to drive successful digital transformations for clients.

Key Milestones in Maveric Systems' History

| Year | Milestone |

|---|---|

| 2000 | Founded as a niche, domain-led BankTech consulting firm in Chennai, India. |

| 2005 | Expanded services to include digital transformation solutions. |

| 2010 | Opened delivery centers in multiple countries to support global clients. |

| 2015 | Grew team to over 1,000 members. |

| 2016 | Featured in Deloitte's Technology Fast 50. |

| 2018 | Strengthened partnerships with leading global banks and fintech companies. |

| 2020 | Introduced innovative platforms and frameworks for digital transformation. |

| 2022 | Scaled team to over 2,600 members, aiming to be among top three niche BankTech specialists by 2025. |

2. Company Values and Culture

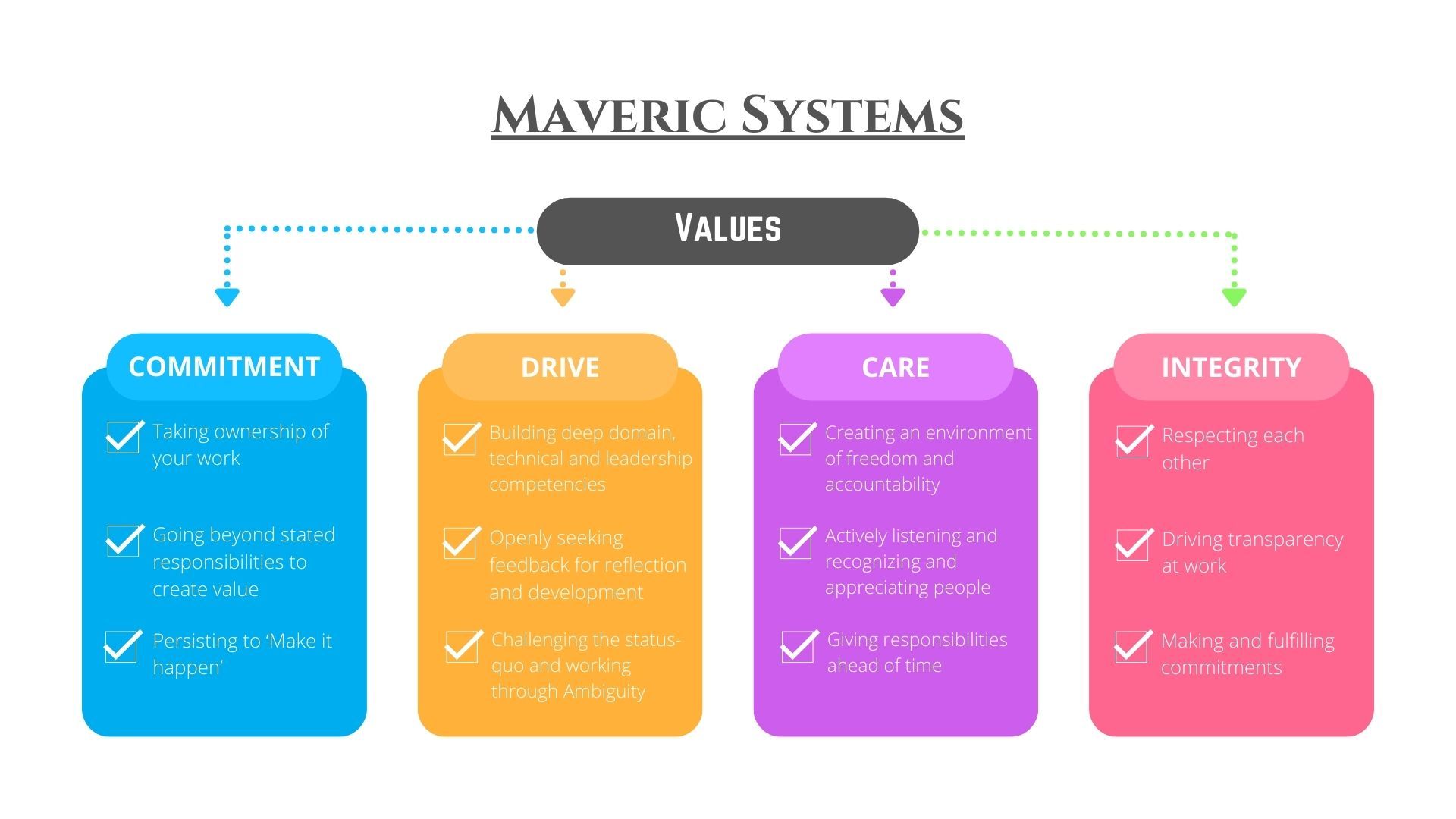

Company Values of Maveric Systems

Key Aspects of Maveric Systems' Corporate Culture

The corporate culture at Maveric Systems is characterized by a strong focus on specialization, employee empowerment, and a commitment to continuous improvement. Here are the key elements that define Maveric's culture based on the provided source:

- Purpose-Driven Focus: Maveric has specialized in the banking sector for over 23 years, concentrating on specific sub-domains. This specialization fosters a deep understanding of the industry and a commitment to delivering tailored solutions.

- People-Centric Environment: The company emphasizes working with exceptional leaders who are respected in the industry. Maveric promotes a culture where employees are encouraged to take on leadership roles and contribute to the success of both external customers and their teams.

- Passion for Excellence: Passion is described as the glue that integrates deep domain knowledge, technology, and high-velocity execution. This passion drives employees to excel and contribute meaningfully to the organization.

- Attributes for Success: Maveric identifies five key attributes that contribute to success within the company:

- Captain of the Ship: Commitment to customer and team success.

- Collective Magnet: Creating a positive environment that attracts talent and drives impactful outcomes.

- The World is My Oyster: Cultivating equitable relationships with all stakeholders.

- Society of Givers: Leaders invest time and energy in mentoring younger associates.

- Be Better Every Day: A culture of seeking feedback and building on others' ideas.

3. Comprehensive Product and Service Offerings at Maveric Systems

Digital Transformation Solutions

- PSD2 compliance, implementation, and support

- Customer acquisition and onboarding

- Microservices and API development

- Mobile app development

- Cloud-native application development

- DevOps

- CRM implementation and support

Core Banking Transformation

- Product-centric offerings on leading banking products aided by frameworks and domain-embedded accelerators

- Pioneered accountability-led managed services engagement models

- Recognized as a niche, domain-led transformation specialist

Data and Analytics

- Data engineering and data platform modernization

- Data quality assurance and data governance

- Advanced analytics and AI/ML solutions

Quality Engineering

- Requirements assurance

- Application assurance

- Program assurance

- Specialized practices in digital banking, data quality assurance, payment systems, and AML

Consulting and Advisory Services

- Digital strategy and roadmap

- Core banking transformation

- Data and analytics strategy

- Quality engineering consulting

4. Financial Performance and Market Position

Maveric Systems has demonstrated strong financial performance and market positioning in the banking technology sector. Here are the key aspects based on the provided search results:

Financial Performance

- Revenue Growth: For the financial year ending March 31, 2023, Maveric Systems reported an operating revenue of over INR 500 crore, reflecting significant growth compared to previous years. The revenue for FY2022 was approximately INR 488.58 crore, indicating a positive trend in revenue generation.

- EBITDA Increase: The company's EBITDA increased by 35.68% over the previous year, showcasing improved operational efficiency and profitability.

- Net Worth: Maveric's net worth grew by 42.10%, indicating a strong financial position and effective management of resources.

- Total Assets: The total assets of the company increased by 25.83%, reflecting growth in its operational capabilities and investments.

- Debt Management: The company maintains a healthy debt-equity ratio of 0.00, indicating no reliance on external debt, which contributes to its strong financial stability.

- Return on Equity: Maveric Systems reported a return on equity of 22.57%, demonstrating effective utilization of shareholder funds to generate profits.

- Current Ratio: The current ratio stands at 3.38, suggesting good liquidity and the ability to meet short-term obligations.

Market Position

- Established Market Presence: Maveric Systems is recognized as a niche, domain-led BankTech specialist, focusing on providing technology solutions to global banks and financial institutions. Its long-standing presence in the market since 2000 has allowed it to build strong relationships with key clients in the banking sector.

- Credit Ratings: CRISIL Ratings has reaffirmed Maveric's long-term rating at 'CRISIL BBB+' with a positive outlook, reflecting the company's stable financial risk profile and operational performance.

- Growth Potential: The company is strategically positioned to capitalize on the increasing demand for digital transformation services in the banking sector, particularly in North America, as it aims to enhance its market offerings and expand its presence.

- Subsidiaries and Global Reach: Maveric operates through several wholly-owned subsidiaries in key markets, including the UK, USA, and Mexico, which enhances its ability to serve clients across different regions effectively.

- Competitive Landscape: While Maveric faces competition from larger firms like Accenture, Cognizant, and TCS, its niche focus and specialized services allow it to maintain a competitive edge in the BankTech industry.

5. Industry Competitors

Maveric Systems faces competition from several major IT services and consulting firms that have strong capabilities in banking technology and digital transformation.

Accenture

Overview

Accenture is a global professional services company with a significant presence in the banking sector, employing over 100,000 professionals focused on financial services.

Services

- Strategy and Consulting: Comprehensive strategic planning and consulting services.

- Digital and Technology: Solutions for core banking transformation, data analytics, and cloud services.

- Operations: Managed services to improve operational efficiency.

Market Position

Accenture is recognized for its extensive experience with major banks, having worked with 7 of the top 15 global banks. Its broad capabilities and global network of technology centers enhance its competitive edge.

Cognizant

Overview

Cognizant is a prominent IT services provider with a dedicated banking industry group comprising over 30,000 professionals.

Services

- Digital Banking Solutions: Focused on enhancing digital banking experiences.

- Core Systems Modernization: Upgrading banking infrastructure for improved performance.

- Data Analytics and Cybersecurity: Advanced analytics solutions and robust cybersecurity measures.

Market Position

Cognizant's partnerships with leading technology providers like AWS and Google Cloud, along with its global delivery centers, position it strongly in the banking sector.

TCS (Tata Consultancy Services)

Overview

TCS is one of the largest IT services companies globally, with a robust banking and financial services vertical.

Services

- Core Banking Transformation: Comprehensive solutions for modernizing banking systems.

- Emerging Technologies: Expertise in cloud, AI, blockchain, and IoT.

- Innovation Initiatives: TCS Pace Ports and co-innovation networks to drive innovation.

Market Position

TCS leverages its vast talent pool of over 500,000 employees and a global delivery model, making it a formidable competitor in the banking technology space.

Wipro

Overview

Wipro is an IT, consulting, and business process services company serving clients in the banking and financial services industry.

Services

- Technology Adoption: Helping banks implement new technologies and business models.

- Core Banking Transformation: Solutions for modernizing core banking systems.

- Data Analytics and Cybersecurity: Expertise in data-driven decision-making and security.

Market Position

Wipro's partnerships with technology providers and its global delivery capabilities enhance its position in the banking sector.

Infosys

Overview

Infosys is a global leader in digital services and consulting, serving many of the world's largest banks.

Services

- Core Banking Modernization: Comprehensive solutions for transforming banking operations.

- Emerging Technologies: Capabilities in cloud, AI, blockchain, and 5G.

- Research and Innovation: Dedicated labs for developing innovative banking solutions.

Market Position

With a talent pool of over 300,000 employees and a strong global delivery model, Infosys is well-positioned to compete in the banking technology landscape.

While Maveric Systems has a niche focus on banking technology and strong domain expertise, these larger IT services firms pose competition due to their scale, broad capabilities, and global reach. However, Maveric aims to differentiate itself through its customer-centric delivery model and deep domain knowledge of the banking industry.

6. Interview Questions at Maveric Systems

Typical interview questions at Maveric Systems often focus on assessing a candidate's skills, experiences, and alignment with the bank's values. Here are some common questions you might encounter:

General Maveric Systems Interview Questions

- Can you tell us about yourself and your background?

- What interests you about working at Maveric Systems?

- How do you prioritize your tasks when working on multiple projects?

- Describe a challenging situation you faced in a previous role and how you handled it.

- What do you know about Maveric Systems and its services?

- How do you stay updated with the latest trends in technology and banking?

- What are your long-term career goals?

- How do you handle feedback and criticism?

- Describe your ideal work environment.

- What motivates you to perform at your best?

Questions About Experience And Background

- Can you describe your previous work experience related to banking technology?

- What specific skills have you gained from your past roles that will benefit you at Maveric Systems?

- Have you worked on any projects involving digital transformation? If so, please elaborate.

- How do you approach problem-solving in your work?

- Can you provide an example of a successful project you were involved in and your role in it?

- What tools and technologies are you proficient in that are relevant to this position?

- Describe a time when you had to learn a new technology or process quickly.

- How do you ensure quality in your work?

- Have you ever led a team or project? What was your approach?

- What have you learned from your previous job that you would apply to this role?

In-Depth Questions

- Explain the concept of Object-Oriented Programming (OOP) and its principles.

- How would you handle defect leakage in a software project?

- Can you write a Java program to check for a palindrome?

- Describe your experience with automation testing tools like Selenium.

- What is the difference between data-driven and keyword-driven frameworks?

- How do you manage version control in your projects?

- Explain the importance of API testing and how you approach it.

- Can you discuss a complex bug you encountered and how you resolved it?

- How do you ensure that your code is maintainable and scalable?

- Describe your experience with Agile methodologies and how you have applied them in your work.

7. Future Outlook and Strategic Plans

Maveric Systems has outlined a strategic vision for future growth and development, focusing on expanding its global footprint and enhancing its service offerings in the banking technology sector. Here are the key aspects of their future outlook and strategic plans:

Key Strategic Objectives

- Board Strengthening: Anil Sachdev and N.S. Parthasarathy joined as Non-Executive Independent Directors to guide Maveric's growth, leveraging their expertise to enhance positioning in banking technology.

- Service Expansion: Maveric will expand into Customer Experience, Payments, Wealth Management, and Regulatory Compliance, focusing on new-age Application Management Services and hybrid cloud solutions.

- Market Expansion: The company is boosting its presence in the USA with a robust sales team and strategic acquisitions to meet the growing demand for digital banking solutions.

- Technological Advancements: Maveric integrates AI, cloud computing, and automation, focusing on cloud-native solutions, digital twin technology, and AI-driven analytics to enhance customer engagement.

- Agility and Innovation: Emphasizing agility, Maveric aims to innovate and respond to market changes with a 4.0 outlook, delivering cutting-edge solutions for the evolving banking sector.

Key Focus Areas

- Digital Transformation: Maveric aids banks in digital transformation with solutions enhancing customer experiences and operational efficiency, focusing on integrated platforms.

- Emerging Technologies: The company invests in composable banking, decision intelligence, and intelligent applications to innovate customer interactions and decision-making.

- Sustainability and Compliance: As Maveric grows, it will emphasize compliance with global regulations, ensuring scalable and secure solutions for diverse markets.

8. Conclusion

Maveric Systems stands out as a niche, domain-led banking technology specialist, dedicated to driving digital transformation in the financial sector. With over two decades of experience, the company leverages its expertise to help banks navigate the complexities of modern banking, focusing on enhancing customer experiences and adopting innovative technologies.

Key Takeaways for Aspiring Maveric Systems Candidates:

- Embrace Digital Transformation: Understand the importance of digital platforms and how they can enhance customer engagement and operational efficiency.

- Focus on Customer Experience: Be prepared to discuss strategies for improving customer journeys and creating emotionally satisfying banking experiences.

- Stay Updated on Technology Trends: Familiarize yourself with emerging technologies such as AI, cloud computing, and data analytics, as these are critical in shaping the future of banking.

- Demonstrate Adaptability: Show your ability to adapt to changing market dynamics and consumer expectations, which is essential in a rapidly evolving industry.

- Highlight Collaboration Skills: Emphasize your experience in working collaboratively across teams and with external partners, as Maveric values a customer-intimacy-led approach.

By aligning your skills and experiences with Maveric Systems' mission and values, you can position yourself as a strong candidate ready to contribute to the firm's success in the banking technology landscape.