Master the Interview at Oxane Partners: Essential Tips for Success

Oxane Partners, founded in 2013 by ex-Deutsche Bank bankers, is a technology-focused solutions provider for the private markets industry. With over 300 employees and offices in London, New York, Gurgaon, and Hyderabad, Oxane Partners specializes in portfolio management, loan servicing, independent valuations, and reporting.

Serving global investment banks, private equity firms, and alternative asset managers, Oxane Partners manages over $400 billion in assets. Renowned for driving digital transformation in private markets, the company emphasizes a collaborative, inclusive work culture that supports professional growth and authenticity among its employees.

1. Overview of Oxane Partners

Oxane Partners

Founding and Early Years (2013-2015)

- 2013: Oxane Partners was established by Sumit Gupta and Vishal Soni, both former credit traders from Deutsche Bank, with a vision to address the challenges in private markets by blending technology with domain expertise.

- 2014: The firm started developing its core technology solutions, initially focusing on portfolio management and risk assessment for private market investments.

- 2015: Oxane Partners opened its first office in London, marking the start of its global expansion.

Diversification and Growth (2016-2020)

- 2016: The company broadened its service offerings to include loan servicing and independent valuations, targeting a wider range of private market clients.

- 2017: Oxane Partners expanded its operations by opening an office in Gurgaon, India, leveraging the region's tech talent.

- 2018: The firm continued to expand its client base, signing several investment firms and banks, further cementing its presence in the private markets technology sector.

- 2019: Oxane launched new solutions to support asset-backed lending and corporate debt management, demonstrating its commitment to innovation and adapting to market demands.

- 2020: The company extended its global presence by opening an office in New York, enhancing its service capabilities for North American clients.

Recent Developments (2021-Present)

- 2021: Oxane Partners reported managing over $400 billion in assets and advanced its technological offerings by integrating advanced data analytics into its solutions.

- 2022: The firm received multiple industry awards for its innovations in portfolio management technology and independent valuations, solidifying its leadership in the sector.

- 2023: Oxane maintained strong growth by signing new global banks and private credit funds, emphasizing digitalization in the evolving economic landscape. The company expanded its services to include ESG (Environmental, Social, and Governance) considerations in investment processes and opened a new office in Hyderabad, India, enhancing its global reach and operational capacity.

Key Milestones in Oxane Partner's History

2. Company Culture and Values

Mission, Vision, and Values

The company aims to achieve this mission by collaborating with investment firms to help them efficiently manage their data and investment processes.

Oxane's mission is to simplify the private markets industry with technology-driven solutions and expert knowledge, empowering market participants to manage investments and grow confidently.

Corporate Culture

Oxane encourages employees to bring their full selves to work, fostering a flexible, fun, and collaborative culture that embraces diversity and supports growth. The corporate culture at Oxane has:

- Equal opportunities for all

- Competitive Pay and Benefits

- Professional growth and development

- Vibrant work culture

- Commitment to their values

3. Comprehensive Product and Service Offerings

Oxane Partners offers a wide range of solutions tailored to various asset classes and business needs within the private markets. Below is a concise overview of their offerings.

Asset Classes

- Asset-Backed Lending: Portfolio management, loan servicing, and independent valuations for asset-backed securities.

- Real Estate: Support throughout the deal lifecycle, including investment analysis and loan servicing, utilizing the Oxane CREST platform.

- Direct Lending: Solutions for managing direct lending portfolios, including performance monitoring and analytics.

- Non-Performing Loans (NPL): Specialized management and valuation for NPL portfolios, focusing on optimizing recovery strategies.

- Structured Products: Analytical support for structured credit transactions and independent valuations, along with comprehensive data management.

- Private Equity: Portfolio management solutions for private equity investments, enhanced by advanced analytics.

- Infrastructure: Management solutions for infrastructure investments, providing tools for visibility and control.

Business Needs

- Transaction Execution Support: Assistance in executing transactions efficiently and compliantly.

- Portfolio Management:

- Asset-Backed Lending: Comprehensive tools for managing portfolios.

- Real Estate: Solutions for monitoring real estate investments.

- Direct Lending: Tailored management for direct lending strategies.

- NPL Portfolios: Specialized services focused on recovery.

- Structured Products: Analytical support for structured investments. - Loan Servicing: Comprehensive solutions covering the entire loan lifecycle.

- Independent Valuation: Objective valuation services for diverse assets.

- Leverage Facility Management: Support for managing leverage facilities and compliance.

4. Industry Positioning and Competitors of Oxane Partners

Industry Positioning

- Market Leadership: Oxane Partners manages over $400 billion in assets for more than 100 clients globally, establishing itself as a leading technology-driven solutions provider in the private markets sector.

- Focus on Digital Transformation: The firm integrates data, technology, and domain expertise to advance portfolio management, risk control, and independent valuations, staying ahead of the growing complexity in private markets.

- Recognition and Awards: Acknowledged as a 'Rising Star' in the Chartis 2023 RiskTech100 report and awarded for its innovations in portfolio management technology and valuation services.

Oxane Partners excels in the private markets technology sector, leveraging its innovative solutions and deep expertise to address evolving client needs.

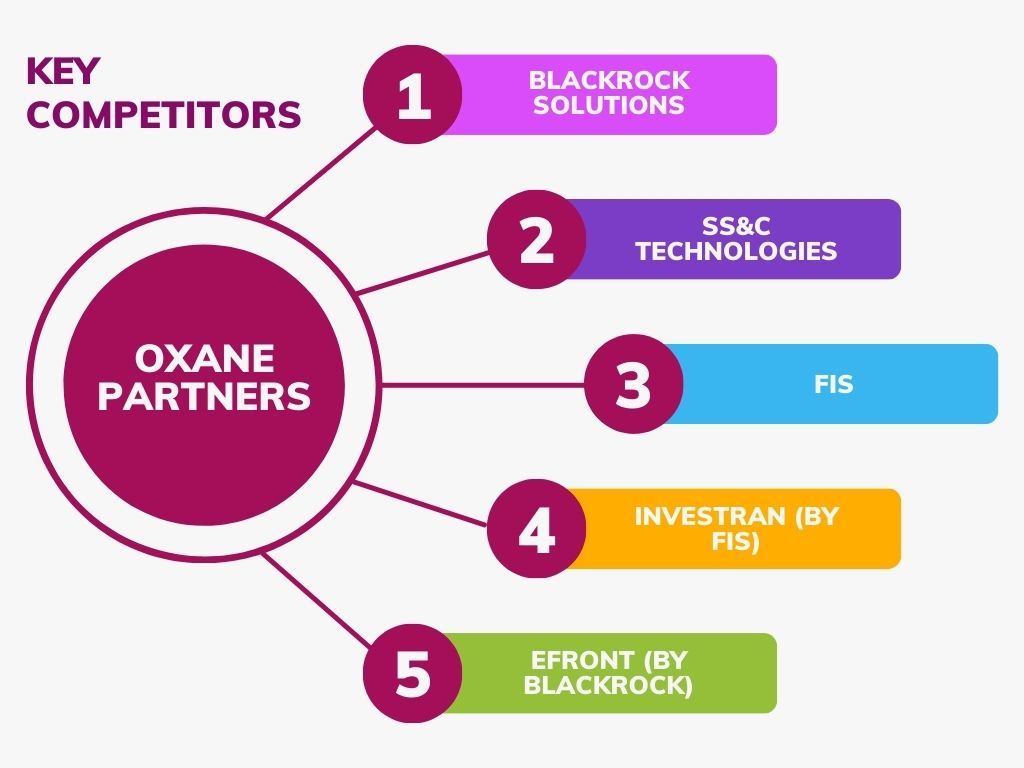

Key Competitors

Oxane Partners operates in a competitive landscape within the private markets technology sector, facing several key players:

- BlackRock Solutions: A leading provider of investment management and risk management technology, offering a comprehensive suite of tools for portfolio management and analytics.

- SS&C Technologies: Known for extensive financial services software solutions, SS&C provides a range of services for asset managers, including portfolio management and loan servicing.

- FIS: A major financial technology player, FIS offers solutions for asset management, risk management, and transaction processing, directly competing with Oxane in the private markets.

- Investran (by FIS): Specializes in integrated solutions for private equity and alternative investment firms, focusing on fund accounting and investor reporting.

- eFront (by BlackRock): A specialized software provider for alternative investment management, offering solutions for portfolio management and risk assessment.

Comparison with Competitors

- Niche Focus: Oxane specializes in the private markets, providing tailored solutions for investment banks, private equity firms, and alternative asset managers, unlike broader-focused competitors.

- Technology-Driven Solutions: The firm leverages advanced technology to create seamless integrations of data and processes, positioning itself as a forward-thinking partner.

- Client-Centric Approach: Oxane emphasizes strong client relationships, ensuring solutions align with strategic goals, differentiating it from larger firms that may prioritize scale.

- Agility and Innovation: As a smaller firm, Oxane can respond quickly to market changes and client needs, fostering innovation in its offerings.

5. Corporate Social Responsibility (CSR)

CSR and Sustainability Initiatives

Oxane Partners has launched several CSR initiatives under Oxane CARES (Corporate Action for Relief and Empowerment of Society), focusing on empowering underprivileged children, especially girls, through education and healthcare.

Key highlights include:

- Collaboration with Dream Girl Foundation: Partnering with this non-profit to enhance healthcare and education for underprivileged girls in India, aiming for a significant societal impact.

- Employee Engagement: Encouraging staff participation in social causes, including hosting children from the Dream Girl Foundation for activities at the office and organizing events like Lunch for Cause, where corporate lunch collections are matched by the firm to support social causes.

6. Typical Interview Questions at Oxane Partners

Here are some typical interview questions one may encounter during the interview process at Oxane Partners:

General Questions

- Can you tell us about yourself and your background?

- What interests you about working at Oxane Partners?

- How do you stay updated on industry trends and developments?

- What are your long-term career goals, and how does this position fit into them?

- How do you prioritize your tasks when managing multiple projects?

Behavioral Questions

- Tell me about a time when you had to deal with a difficult client or team member. How did you handle the situation?

- Describe a project where you had to collaborate with a diverse team. What challenges did you face, and how did you overcome them?

- Give an example of a time when you had to think creatively to solve a problem. What was the outcome?

- How do you prioritize your tasks when you have multiple deadlines and competing priorities?

- Can you share an experience where you took the initiative to improve a process or implement a new idea?

Technical Questions

- What is your understanding of the audit process and the role of internal controls?

- How would you approach a risk assessment for a client engagement?

- Can you explain the key components of a financial statement and their purpose?

- What experience do you have with data analytics tools and techniques?

- How would you go about identifying and mitigating potential conflicts of interest in a client engagement?

7. Future Outlook and Strategic Plans for Oxane Partners

Strategic Vision

- Market Leadership: Solidify position as a leading technology-driven solutions provider in the private markets.

- Scalable Solutions: Address the growing demand for scalable, digital solutions in portfolio and risk management.

- Unified Ecosystem: Develop a comprehensive platform for proactive risk control, portfolio surveillance, reporting, and independent valuations.

- Innovation: Leverage deep domain expertise and advanced technology to enhance service offerings.

- Client Expansion: Continue growth by expanding the client base, including top global investment banks, and adapting offerings to evolving needs.

Upcoming Projects and Innovations

- Global Expansion: The recent opening of a new office in Hyderabad, India, supports the firm's global client base and growing talent pool, enhancing operational capabilities.

- Technology Enhancements: Oxane is focused on continuous innovation, particularly in portfolio management, data services, and valuations, incorporating advanced data analytics and digital tools.

- Client Engagement: The firm aims to expand its annual client forum, "Engage," to foster networking among industry leaders, strengthen existing client relationships, and attract new clients.

- Digital Transformation: As digitalization becomes more critical for investment firms, Oxane plans to enhance its technology offerings to provide comprehensive support for investment operations and reporting needs.

- Talent Development: The firm plans to increase its workforce to support growth and innovation, ensuring it has the necessary talent to meet evolving client demands.

8. Conclusion

Oxane Partners stands out as a leading technology-driven solutions provider in the private markets, combining deep domain expertise with innovative technology to meet the evolving needs of investment firms. With a commitment to fostering a vibrant, inclusive workplace and a focus on professional growth, Oxane is well-positioned for continued success in the industry. Aspiring candidates should recognize the company's emphasis on meritocracy, collaboration, and client-centric values as key components of its culture.

Key Takeaways for Aspiring Oxane Partners Candidates

- Embrace Diversity: Oxane values diverse backgrounds and perspectives. Candidates should highlight their unique experiences and how they can contribute to a collaborative environment.

- Focus on Professional Growth: The firm offers ample opportunities for mentorship and career development. Candidates should express their eagerness to learn and grow within the organization.

- Demonstrate Passion for Technology: Given Oxane's emphasis on technology solutions, candidates should showcase their technical skills and enthusiasm for innovation in the private markets.

- Align with Core Values: Understanding and aligning with Oxane's core values—Client Focus, People First, Collaboration, Excellence, Openness, and Passion—will be crucial for candidates during the interview process.

Tips for Interview Success

- Prepare for Behavioral Questions: Be ready to discuss past experiences that demonstrate your problem-solving abilities, teamwork, and adaptability.

- Showcase Technical Knowledge: If applying for a technical role, be prepared to discuss relevant tools, technologies, and methodologies you have used in previous positions.

- Ask Insightful Questions: Engage your interviewers by asking thoughtful questions about the company's culture, future projects, and industry trends.

- Be Authentic: Oxane encourages candidates to "bring their whole selves to work." Authenticity can help you stand out during the interview process.

- Follow-up: After the interview, consider sending a thank-you note to express your appreciation for the opportunity and reiterate your interest in the position.

By keeping these takeaways and tips in mind, aspiring candidates can enhance their chances of success in securing a role at Oxane Partners.