Deutsche Bank India, established in 1980, has become one of the largest foreign banks in the country, operating 17 branches across major cities. The bank provides a comprehensive range of financial services, including corporate and transaction banking, investment banking, asset management, and retail banking. With a workforce of over 21,000 employees, Deutsche Bank India focuses on delivering integrated financial solutions to corporations, governments, and individual clients. The bank also emphasizes its commitment to corporate social responsibility, engaging in various community initiatives to support education and environmental sustainability, thereby enhancing its role as a responsible corporate citizen in India

This blog aims to provide in-depth insights into Deutsche Bank's operations, corporate culture, and recruitment strategies, empowering prospective candidates with the essential knowledge and resources to excel in securing a position at this prestigious global financial institution.

1. Deutsche Bank Overview

About

| Attribute | Details |

|---|---|

| Founder |

Ludwig Bamberger Adelbert Delbrück |

| Industry Type | Banking and Financial Services |

| Founded | 1870 |

| Headquarters | Frankfurt, Germany |

History

Early Years (1870-1914)

- 1870: Deutsche Bank was founded in Berlin on January 22, primarily to facilitate trade relations between Germany and the United States.

- 1873: The bank expanded its operations internationally, but the Panic of 1873 led to financial difficulties, impacting its early growth.

- 1880s: Deutsche Bank began to establish a network of branches and engaged in financing major industrial projects, including railways and infrastructure.

- 1895: Celebrated its 25th anniversary, reflecting on its growth and the challenges faced, including economic downturns.

- 1900: The bank became a key player in the financing of the German economy, participating in significant industrial ventures.

- 1914: By the outbreak of World War I, Deutsche Bank had established itself as a major financial institution in Germany and abroad.

Interwar Period (1918-1939)

- 1918: Post-World War I, the bank faced challenges due to the Treaty of Versailles and the economic instability in Germany.

- 1920s: The bank adapted to the Weimar Republic's economic conditions, engaging in international financing and investment.

- 1929: The Great Depression began, leading to significant financial strain on the bank and the broader economy.

- 1933: With the rise of the Nazi regime, Deutsche Bank had to navigate complex political and economic landscapes, impacting its operations.

World War II and Aftermath (1939-1949)

- 1939-1945: During World War II, Deutsche Bank was involved in financing the war effort and faced scrutiny for its role during the Nazi era.

- 1945: By the end of the war, the bank was on the brink of collapse, mirroring the devastation of the German economy.

- 1949: The bank began to rebuild, focusing on the domestic market and gradually re-establishing its international presence.

Post-War Recovery and Expansion (1950-1989)

- 1950s: Deutsche Bank played a crucial role in Germany's post-war economic recovery, benefiting from the Marshall Plan and the economic boom.

- 1970: Celebrated its 100th anniversary, reflecting on its resilience and adaptation through various economic challenges.

- 1980s: The bank expanded its global operations, becoming a significant player in international finance and investment banking.

Modern Era (1990-Present)

- 1990: Following the reunification of Germany, Deutsche Bank expanded its operations into Eastern Europe and increased its global footprint.

- 2001: The bank faced challenges due to the bursting of the dot-com bubble and subsequent economic downturns.

- 2008: The global financial crisis tested the bank's resilience, leading to significant restructuring and a focus on risk management.

- 2017: Deutsche Bank issued an official apology for past missteps and began implementing tighter controls and governance.

- 2019: Announced a new strategy aimed at sustainable growth, building on its historical strengths and global network.

- 2020: Celebrated its 150th anniversary, reflecting on its long and eventful history, including its role in global finance.

Key Milestones in Deutsche Bank’s History:

| Year | Milestone |

|---|---|

| 1870 | Deutsche Bank founded in Berlin to facilitate trade between Germany and the U.S. |

| 1873 | The Panic of 1873 caused financial challenges for the bank. |

| 1895 | Celebrated 25 years of growth despite economic difficulties. |

| 1914 | Became a major player in global finance by World War I. |

| 1929 | Faced the economic impact of the Great Depression. |

| 1945 | Near collapse at the end of World War II. |

| 1970 | Celebrated its 100th anniversary. |

| 2008 | Restructured during the global financial crisis. |

| 2019 | Announced a new strategy for sustainable growth. |

| 2020 | Marked its 150th anniversary as a global financial institution. |

2. Company Culture and Values

Purpose

The bank focuses on offering client solutions, ensuring competitiveness, profitability, and strong capital foundations. Its culture emphasizes balanced risk and reward, while attracting and developing talented individuals through teamwork, inclusion, and trust to meet high standards.

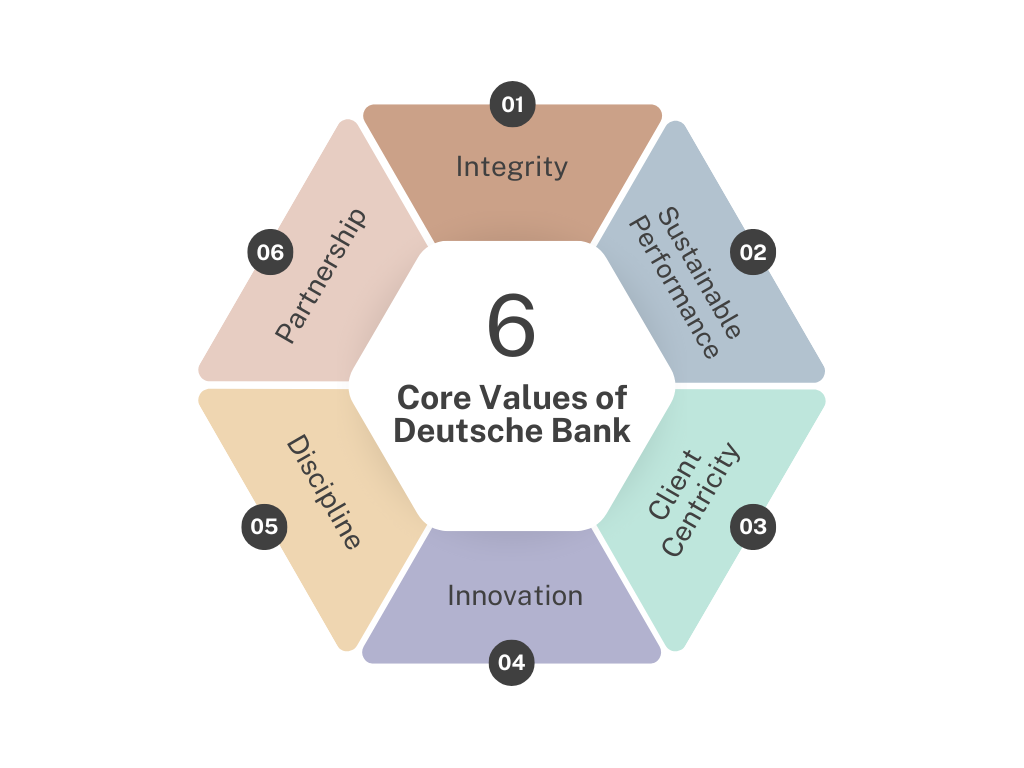

Core Values of Deutsche Bank

Deutsche Bank’s values shape its approach to business and relationships with clients, stakeholders, and employees. They emphasize ethical conduct, long-term success, and collaboration, ensuring that the bank operates responsibly and effectively in a global context. The key values are:

- Integrity: Act with honesty and maintain high ethical standards.

- Sustainable Performance: Focus on long-term success by balancing risks and returns.

- Client Centricity: Place clients at the center and deliver on promises.

- Innovation: Embrace new approaches with careful risk management.

- Discipline: Accept responsibility, honor commitments, and learn from mistakes.

- Partnership: Foster collaboration and diversity for better decision-making and stronger relationships with stakeholders.

3. Comprehensive Product and Service Offerings

Deutsche Bank offers a diverse range of products and services across four core business segments, each designed to meet the needs of various client categories. Here’s a comprehensive list:

1. Corporate Bank

- Financing Solutions: Tailored financing options for corporations and medium-sized companies.

- Transaction Banking: Payment and credit solutions for businesses, including small businesses and self-employed individuals.

- Banking Services: Offered through multiple brands, including Deutsche Bank, Postbank, and the digital bank FYRST.

2. Investment Bank

- Risk Management: Comprehensive services for fixed income and currency risk management.

- Liquidity Provision: Solutions to ensure clients have the necessary liquidity.

- Financing Capabilities: Leading capabilities in financing, including capital raising.

- Origination and Advisory Services: Full suite of services to support corporate and institutional clients in their financing needs.

3. Private Bank

- Financing and Investment Solutions: Expertise in addressing financing and investment questions for private clients in Germany.

- Tailored Investment Solutions: Customized offerings for affluent clients and family entrepreneurs globally.

4. Asset Management

- Investment Products: A wide array of active, passive, and alternative investment products.

- Market Positioning: Solutions designed to help investors navigate various market scenarios.

These offerings reflect Deutsche Bank's commitment to client-centricity, ensuring that they can respond effectively to the evolving needs of their clients across different sectors.

4. Financial Performance and Market Position

Deutsche Bank Stock Performance

This section provides a visual representation of the company's stock price over time, illustrating trends, volatility, and overall market performance. This graph helps stakeholders gauge the stock's financial health and investment potential.

Key Financial Metrics Table

This table outlines key financial ratios and metrics such as the Current Ratio, Gross Profit Margin, and Net Profit Margin, among others. These figures are crucial for analyzing the company's financial stability, operational efficiency, and profitability over various quarters.

5. Competitors of Deutsche Bank

These competitors of Deutsche Bank are similar in size and scope to the bank, operating globally across retail, commercial, and investment banking. They are all large, diversified financial institutions with significant market share in their respective regions and product areas.

1. UBS Group AG

- Overview: UBS is a global financial services company based in Switzerland, offering wealth management, asset management, and investment banking.

- Services: UBS provides services similar to Deutsche Bank, including investment banking, wealth management, and advisory services for individuals, companies, and institutions.

- Market Position: UBS competes with Deutsche Bank in Europe and globally, especially in wealth management and investment banking. Both institutions serve high-net-worth individuals and corporate clients.

2. Goldman Sachs Group Inc.

- Overview: Goldman Sachs is a leading global investment banking, securities, and investment management firm.

- Services: Goldman Sachs offers services in investment banking, securities trading, and investment management to a wide range of institutional and high-net-worth clients.

- Market Position: Goldman Sachs competes with Deutsche Bank primarily in investment banking and wealth management, especially in areas such as mergers & acquisitions (M&A) and capital market services.

3. HSBC

- Overview: HSBC is a British multinational bank with a strong presence in Europe, Asia, and North America.

- Services: HSBC offers commercial banking, global banking, wealth management, and investment banking services.

- Market Position: HSBC competes with Deutsche Bank in corporate banking, investment banking, and asset management. Both institutions are key players in international banking with a large footprint across multiple markets.

4. Morgan Stanley

- Overview: Founded in 1935 and headquartered in New York City, Morgan Stanley is a leading global financial services firm that provides a wide range of investment banking, securities, wealth management, and investment management services.

- Services: Morgan Stanley offers services in investment banking, sales and trading, wealth management, and asset management. It focuses heavily on serving institutional investors and high-net-worth individuals.

- Market Position: Morgan Stanley is considered one of the top investment banks in the world and is a key player in the capital markets, often competing directly with Goldman Sachs and UBS.

5. JPMorgan Chase

Overview: JPMorgan Chase is one of the largest banking institutions in the world, offering a range of financial services including investment banking, asset management, and wealth management.

Services: It provides commercial banking, consumer banking, corporate banking, and investment banking, similar to Deutsche Bank.

Market Position: JPMorgan Chase competes directly with Deutsche Bank in global investment banking, asset management, and corporate banking services. Its strong global presence and diverse offerings make it one of Deutsche Bank's top competitors.

6. Corporate Social Responsibility (CSR)

Deutsche Bank's Corporate Social Responsibility (CSR) initiatives encompass a variety of programs aimed at addressing societal challenges and supporting communities. Here are the key areas of focus:

7. Recruitment Process at Deutsche Bank

Deutsche Bank’s recruitment process is aimed at identifying and nurturing top talent by offering a comprehensive and engaging journey from exploration to onboarding. The process is designed to assess both skills and cultural fit, ensuring candidates are well-prepared and aligned with the bank’s values and objectives.

1. Explore and Research

- Programs Available: Explore various programs for different stages of study or post-graduation.

- Employability Hub: Utilize the hub for application and assessment support.

- Events: Attend events to interact with employees and learn more.

- Unofficial Guide to Banking: Understand the bank’s structure and divisions to identify where you fit in.

2. Apply

- Application: Search for and apply for roles on the “Apply” page. In India, apply via campus.

- Submission: Complete a short application form and attach your CV. Check eligibility criteria in job descriptions.

3. Online Assessments

- Eligibility Screen: Begin with an eligibility check.

- Situational Judgement Test: Assess alignment with Deutsche Bank’s values (except in the US and India).

- Behaviour and Ability Assessments: Evaluate behavioural preferences, personality style, and critical reasoning skills. Feedback reports will be provided.

4. Virtual Interview

- Format: Video interview in the UK and APAC regions, or virtual meetings in other regions.

- Preparation: Prepare for questions and discuss your motivations and skills.

5. Assessment Centre/Super Day

- In-Person Assessments: Includes competency assessments, case studies, and technical interviews.

- India: Interviews are conducted on campus.

6. Joining Deutsche Bank

- Outcome: Receive a call with the outcome and feedback within a week.

- Decision: Provide your offer decision within two weeks.

- Welcome Hub: Receive information and advice to prepare for your first day. Program start dates vary by region.

For more information, visit Deutsche Bank.

8. Future Outlook and Strategic Plans

Deutsche Bank is focused on delivering long-term sustainable growth through innovation, digital transformation, and maintaining financial stability. Below are some of Deutsche Bank’s key strategic initiatives:

Digital Transformation and Innovation

Deutsche Bank is investing heavily in digital transformation to enhance customer experience, improve operational efficiency, and strengthen cybersecurity. The bank is modernizing its technology stack and collaborating with FinTech companies.

- Expanding digital banking services and improving online banking platforms to enhance customer experience.

- Collaborating with FinTech firms to integrate innovative solutions into Deutsche Bank’s product offerings.

Cost Efficiency and Profitability

Deutsche Bank is focused on improving profitability by optimizing its operations and reducing costs. The bank is restructuring its business model to focus on core profitable areas while exiting non-strategic businesses.

- Implementing cost-cutting measures to improve profitability and enhance operational efficiency.

- Streamlining global operations and focusing on high-margin business segments such as corporate finance and asset management.

Sustainability and ESG Initiatives

Deutsche Bank is committed to integrating environmental, social, and governance (ESG) factors into its business model. The bank has established ambitious targets to support sustainable finance and reduce its carbon footprint.

- Expanding its portfolio of sustainable financial products such as green bonds and sustainable investment funds.

- Committing to achieving net-zero carbon emissions in its operations by 2050 and providing sustainable financing solutions for its clients.

Strengthening Risk and Regulatory Compliance

Deutsche Bank is strengthening its risk management and compliance frameworks to navigate increasing regulatory scrutiny. The bank is focusing on internal controls, operational risk management, and adhering to global financial regulations.

- Enhancing internal risk controls to manage operational risks and comply with global financial regulations.

- Expanding the team of regulatory compliance specialists to ensure Deutsche Bank meets all regulatory standards.

Focus on Wealth Management and Asset Growth

Deutsche Bank aims to expand its wealth management division by offering personalized services to high-net-worth individuals and institutional investors. The bank is focused on growing its assets under management through innovative investment products.

- Expanding wealth management services across Europe, Asia, and North America to cater to affluent clients.

- Offering personalized investment strategies and financial planning solutions to high-net-worth clients.

Expansion in Emerging Markets

Deutsche Bank is expanding its presence in emerging markets to capture growth opportunities in Asia, Latin America, and Africa. The bank aims to provide innovative financial solutions to corporations and individuals in these high-growth regions.

- Expanding operations in emerging markets to offer corporate finance, investment banking, and asset management services.

- Building partnerships with local financial institutions to strengthen its footprint in key emerging markets.

9. Latest News & Updates about Deutsche Bank

Stay updated with the latest news from Deutsche Bank, including insights on global financial services, strategic initiatives, and innovations in banking technology. Discover how Deutsche Bank is navigating global markets and shaping the future of financial services with its comprehensive banking solutions and investment strategies.

10. Conclusion

Deutsche Bank continues to navigate the complexities of the global financial landscape with a clear focus on sustainability, digital transformation, and client-centricity. By setting ambitious targets for revenue growth and sustainable financing, the bank aims to enhance its market position while addressing pressing environmental challenges. Its commitment to integrating advanced technology and fostering diversity within its workforce reflects a proactive approach to future challenges. As Deutsche Bank evolves, it remains dedicated to serving its clients and society, positioning itself as a leader in the banking industry while contributing positively to global economic and environmental goals.

Key Takeaways for Aspiring Deutsche Bank Candidates:

- Research Thoroughly: Understanding Deutsche Bank's culture, values, and various divisions is crucial. Utilize resources like the bank's careers site and the Employability Hub to gather insights.

- Tailor Your Application: Customize your CV and cover letter to reflect your unique experiences and how they align with the role you are applying for. Highlight your passion for the banking industry and any relevant skills.

- Prepare for Assessments: Familiarize yourself with the application process, which includes psychometric tests and interviews. Practice common interview questions and use the STAR method to structure your responses.

- Network Actively: Engage with current employees, attend Deutsche Bank events, and connect with alumni to gain insights and build relationships that can enhance your application.

- Commit to Continuous Learning: Stay updated on industry trends and consider pursuing additional certifications. Demonstrating a commitment to professional growth will set you apart from other candidates.

By focusing on these key areas, aspiring candidates can effectively position themselves for a successful career at Deutsche Bank.