Goldman Sachs: Prepare for Your GBM Private Summer Analyst Interview- Essential Tips and Strategies

1. Introduction to the Role

Goldman Sachs is a global leader in financial services, known for connecting people, capital, and ideas to solve problems for clients across the world. The Summer Analyst role in GBM Private at Goldman Sachs offers a unique opportunity to work within the Investment Banking team, which specializes in providing top-tier advice and execution across mergers and acquisitions, equity offerings, debt issuances, and derivative transactions.

This blog is designed to guide you through the interview process, offering valuable insights and preparation tips to help you secure your position as a Summer Analyst in GBM Private.

2. Required Skills and Qualifications

To excel as a Summer Analyst in GBM Private at Goldman Sachs, you need a strong educational background in finance or a related field, along with technical, quantitative, and interpersonal skills that align with the demands of the role.

Educational Background and Certifications:

- Master’s degree in Finance, Accounting, or a related field.

- Strong academic performance in relevant coursework and any related internships or work experience.

Key Technical and Soft Skills:

- Quantitative and Technical Abilities: Strong skills in financial analysis, forecasting, and the use of Microsoft Office products.

- Communication Skills: Excellent communication and interpersonal skills to work effectively with team members, clients, and stakeholders.

- Problem-Solving Abilities: Ability to analyze complex financial data and develop solutions to meet client needs.

- Basic IB Product Knowledge: Familiarity with Investment Banking products, particularly M&A and financing products.

- Proactive and Team-Oriented: Enthusiastic and proactive approach, with a strong orientation towards teamwork and client service.

- Dedication to Deadlines: Ability to meet strict and aggressive deadlines, ensuring timely delivery of high-quality work.

3. Key Responsibilities

- Support the Investment Banking team by driving business planning and forecasting, focusing on revenues and expenses.

- Manage and control the division’s expense base, ensuring efficiency and cost-effectiveness.

- Liaise with business unit CFOs, regional finance teams, and other stakeholders to ensure alignment and accurate reporting.

- Perform client profitability and competitor analysis, providing insights to drive business strategies.

- Track and analyze market share across various segments, including mergers, equity, high-yield, and investment-grade products.

- Report and analyze expenses and spending by region/division, focusing on expense recoverability and savings.

- Work on client revenue metrics, analyzing top clients of the division and the frequency of revenue generation.

4. Tools and Technologies Used

Proficiency with the tools and technologies used in the Summer Analyst role at Goldman Sachs GBM Private will enable you to perform your duties more effectively and stay competitive.

- Microsoft Office Suite: Advanced proficiency in Excel, PowerPoint, and other Microsoft Office tools for financial analysis, reporting, and presentations.

- Financial Software: Familiarity with financial analysis and modeling tools commonly used in Investment Banking.

- Data Analysis Tools: Use of data analysis software to track and analyze market share, expenses, and revenue metrics.

5. Career Progression Opportunities

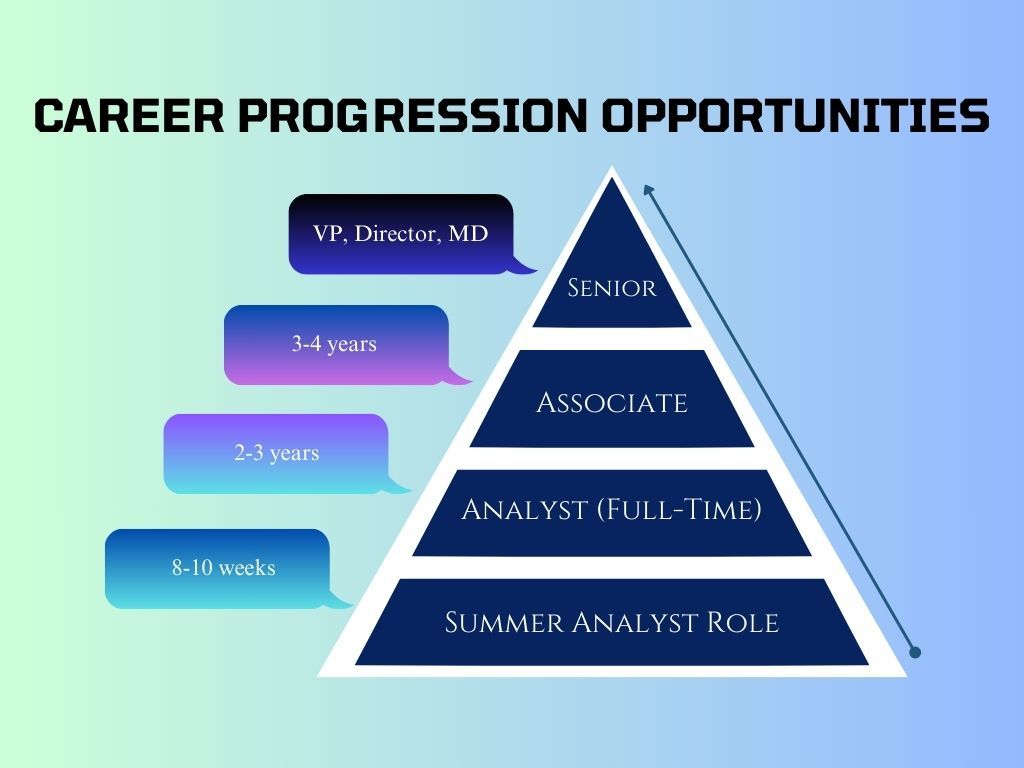

The career progression path for a Summer Analyst role in the Global Banking & Markets (GBM) Private division at Goldman Sachs typically follows a structured trajectory, beginning with the internship and potentially leading to full-time positions and beyond. Here’s an overview of the progression:

1. Summer Analyst Role

- Duration: The Summer Analyst Program lasts between eight to ten weeks and is designed for undergraduate and postgraduate students, usually in their second or third year of study.

- Responsibilities: Summer Analysts are immersed in day-to-day activities, gaining exposure to various aspects of the business, including financial analysis, market research, and client interactions. They work closely with full-time analysts and associates, contributing to projects and learning the operational aspects of the division.

2. Full-Time Analyst Position

- Conversion: Successful Summer Analysts often receive offers to return as full-time Analysts after graduation. This transition is contingent on performance during the internship, demonstrating both technical skills and cultural fit within the firm.

- Duration: The Analyst role typically lasts for two to three years. During this time, Analysts are expected to deepen their knowledge, develop technical skills, and take on increasing responsibilities.

3. Associate Role

- Promotion: After completing the Analyst program, individuals may be promoted to Associate positions. This usually occurs after two to three years of experience as an Analyst. Associates often have more client-facing responsibilities and may lead projects.

- Pathways to Associate: Some Analysts pursue further education, such as an MBA, which can facilitate their transition to an Associate role, particularly if they aim for positions in investment banking or other competitive areas within Goldman Sachs.

4. Senior Roles

- Vice President and Beyond: After serving as an Associate for a few years, professionals can progress to Vice President (VP), then to Director, and finally to Managing Director (MD). Each step up typically requires demonstrated leadership, significant contributions to the firm, and the ability to manage teams and client relationships effectively.

- Skill Development: Throughout this progression, continuous learning and skill enhancement are emphasized. Goldman Sachs supports this through various training programs and mentorship opportunities, fostering an environment where junior team members learn from seasoned professionals.

The career path from a Summer Analyst in the GBM Private division at Goldman Sachs is structured to provide a clear route to advancement, with opportunities for skill development and leadership roles as one progresses through the ranks.

6. Main Topics to Prepare for the Interview

To excel in your interview for the Summer Analyst role in GBM Private at Goldman Sachs, focus on the following topics:

- Understand the principles of financial analysis, including forecasting revenues and expenses, and how they impact business planning.

- Be familiar with techniques for managing and controlling divisional expenses.

- Gain knowledge of Investment Banking products, particularly M&A, equity offerings, and debt issuances.

- Be prepared to discuss how these products are used to meet client needs and drive business growth.

- Learn how to perform client profitability analysis, including identifying key clients and analyzing their revenue contributions.

- Be prepared to discuss how competitor analysis is used to inform business strategies.

- Understand how to track and analyze market share across different segments, and how this data is used to drive business decisions.

- Be familiar with techniques for analyzing expenses by region/division and identifying opportunities for savings.

- Demonstrate your ability to communicate financial insights to stakeholders, including business unit CFOs and regional finance teams.

- Be prepared to discuss how you manage relationships with key stakeholders to ensure alignment and accurate reporting.

7. Interview Process for GBM Private Summer Analyst Role

Here are some real interview questions and experiences for a Summer Analyst position in the Investment Banking Division (IBD) at Goldman Sachs, based on the job description provided:

Interview Process

1. Resume Screen

- Ensure your resume highlights relevant coursework, internships, and projects related to finance and investment banking.

2. Hirevue (Video Interview)

- Expect 3-6 behavioral questions, with 30 seconds of prep time and 2 minutes to answer each.

- Practice answering questions like "Why Goldman Sachs?" and "Walk me through your resume."

3. Superday (Final Round Interviews)

- Prepare for 3-4 back-to-back interviews, with a mix of technical and behavioral questions.

- Be ready to discuss your interest in investment banking and Goldman Sachs specifically.

8. Interview Questions

The Goldman Sachs GBM Private Summer Analyst interview will evaluate both your technical and behavioral competencies. You’ll encounter a mix of general, technical, behavioral, and problem-solving questions designed to assess your expertise and fit for the role.

General Questions

- Why do you want to work at Goldman Sachs?

- What interests you about the Global Banking & Markets division?

- How do you see yourself contributing to our team?

- What do you hope to learn during your internship?

- Can you describe your understanding of the role of a Summer Analyst in the GBM Private division?

Technical Questions

- What are the key financial statements, and how do they interrelate?

- Can you explain the concept of discounted cash flow (DCF) analysis?

- What is the role of an investment bank in the capital markets?

- How would you evaluate whether a company is a good investment?

- What are some current trends in the financial markets that interest you?

Behavioral Questions

- Tell me about a time you worked on a team project. What was your role, and what was the outcome?

- Describe a situation where you faced a significant challenge. How did you handle it?

- Have you ever had a conflict with a team member? How did you resolve it?

- Give an example of a time when you had to meet a tight deadline. What steps did you take?

- Tell us about a project you are particularly proud of. What was your contribution?

Role-Specific Questions

- What do you understand about the specific products and services offered by the GBM Private division?

- How do you think recent market trends will affect our clients in the private sector?

- Can you discuss a recent deal or transaction in the market that caught your attention?

- What skills do you believe are essential for success in the GBM Private division?

- How would you approach building a financial model for a client?

Problem-Solving Questions

- If given a dataset, how would you analyze it to derive insights for a potential investment?

- Imagine a client is unhappy with the performance of their portfolio. How would you address their concerns?

- You are tasked with presenting a market analysis. What steps would you take to prepare?

- How would you prioritize tasks if you had multiple deadlines approaching?

- If you identified a mistake in a financial report just before a client meeting, what would you do?

9. Salary and Compensation

Understanding the compensation structure is essential when considering a role at Goldman Sachs. Here’s an overview:

- Base Salary: Competitive salary based on experience and location.

- Variable Pay: Performance-based bonuses and incentives may be offered based on individual and company performance.

- Benefits: Goldman Sachs offers a comprehensive benefits package, including health insurance, retirement plans, and opportunities for professional development.

10. Conclusion

Starting your career as a Summer Analyst in GBM Private at Goldman Sachs offers an excellent opportunity to work in a dynamic and innovative environment focused on delivering high-quality Investment Banking services to global clients. This role is ideal for finance professionals who are detail-oriented, analytical, and passionate about Investment Banking. By thoroughly preparing and aligning your skills with Goldman Sachs' expectations, you can excel in the interview process and build a rewarding career in Investment Banking.

Tips for Interview Success:

- Master Financial Analysis and Forecasting Concepts: Ensure you’re proficient in financial analysis, forecasting, and managing expenses in an Investment Banking context.

- Prepare for Case Studies: Practice case studies related to Investment Banking to demonstrate your analytical skills and problem-solving abilities.

- Understand Goldman Sachs’ Culture: Align your career goals with Goldman Sachs’ values of integrity, teamwork, and client service.

- Be Professional and Confident: Display confidence in your knowledge and maintain professionalism throughout the interview process.

- Ask Insightful Questions: Show your genuine interest in the role by asking thoughtful questions about the team, projects, and career growth opportunities.

By following these guidelines, you'll be well-prepared to make a strong impression and secure a position as a Summer Analyst in GBM Private at Goldman Sachs. Good luck!