Goldman Sachs: Prepare for Your GIR Summer Analyst Interview- Essential Tips and Strategies

1. Introduction to the Role

Goldman Sachs is a global leader in financial services, known for its expertise in connecting people, capital, and ideas to solve complex problems. The Summer Analyst role in Global Investment Research (GIR) at Goldman Sachs offers a unique opportunity to work with some of the brightest minds in finance, delivering insightful research that drives investment decisions worldwide.

This blog is designed to guide you through the interview process, offering valuable insights and preparation tips to help you secure your position as a Summer Analyst in GIR at Goldman Sachs.

2. Required Skills and Qualifications

To excel as a Summer Analyst in GIR at Goldman Sachs, you need a strong educational background, analytical skills, and a passion for financial research.

Educational Background and Certifications

- Bachelor’s or Master’s degree in Finance, Economics, or a related field.

- Strong academic performance in relevant coursework, internships, or research experience.

Key Technical and Soft Skills

- Analytical Abilities: Proficiency in analyzing financial data, market trends, and economic indicators.

- Research Skills: Ability to compile, summarize, and analyze market-based data, supporting the production of detailed research reports.

- Communication Skills: Excellent written and verbal communication skills to effectively convey research findings to stakeholders.

- Technical Proficiency: Familiarity with statistical analysis tools and financial modeling techniques.

- Intellectual Curiosity: A strong passion for understanding market dynamics, company fundamentals, and global economic trends.

- Team Collaboration: Ability to work collaboratively in a fast-paced, team-oriented environment.

3. Key Responsibilities

- Work closely with global analyst teams to produce cutting-edge research, focusing on specific geographies and sectors.

- Compile, summarize, and analyze market-based data, contributing to detailed research reports on companies, industries, and economies.

- Build and maintain financial models, analyzing market share, macro trends, and cross-company data within specific sectors.

- Perform statistical analysis of economic data, fundamentals, and correlations, identifying key insights for investment decisions.

- Assist in writing research reports, updating valuation sheets, and maintaining monthly reports, marketing books, and weekly summaries.

- Listen to and produce briefing notes on comparative companies’ conference calls not covered by the team, ensuring comprehensive market coverage.

- Check annual reports for discrepancies and additional data, ensuring the accuracy and reliability of research outputs.

4. Tools and Technologies Used

Proficiency with the tools and technologies used in the Summer Analyst role at Goldman Sachs GIR will enable you to perform your duties more effectively and stay competitive in the role.

- Financial Modeling Tools: Advanced Excel and other financial modeling software for building and maintaining company models.

- Data Analysis Tools: Familiarity with statistical analysis software for analyzing economic data, market trends, and company fundamentals.

- Research Platforms: Use of financial research platforms like Bloomberg or Reuters for gathering and analyzing market data.

- Collaboration Tools: Experience with platforms like Microsoft Teams or Zoom for effective communication and teamwork within global analyst teams.

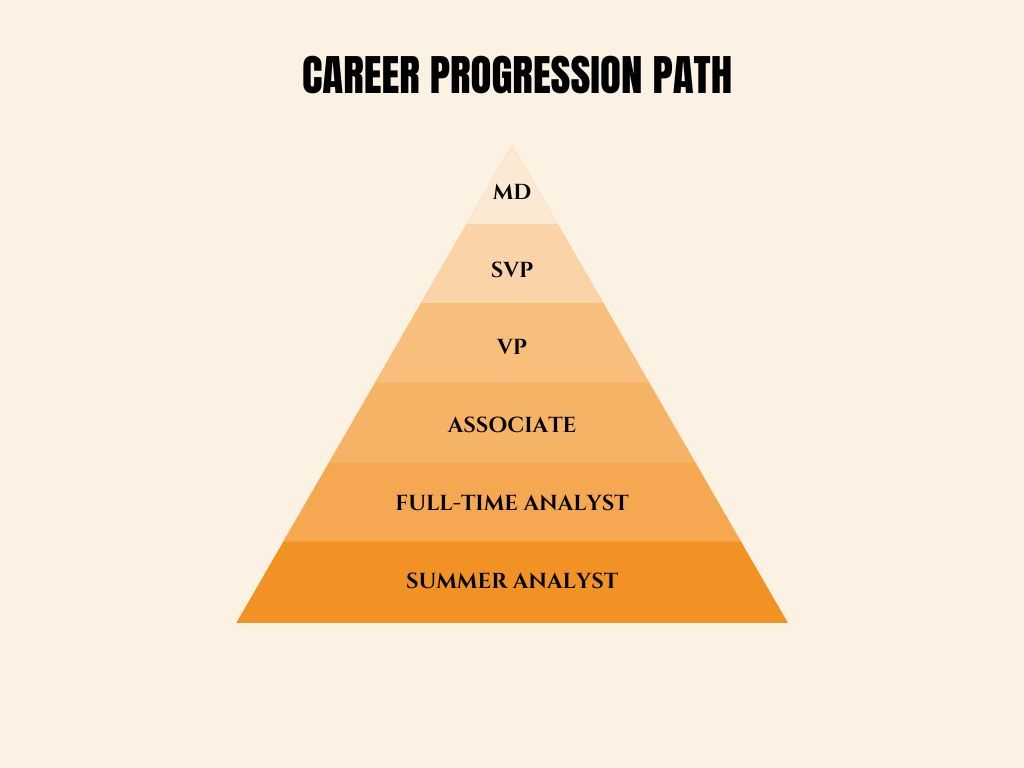

5. Career Progression Path

The career progression path for a Summer Analyst role in the Global Investment Research (GIR) division at Goldman Sachs typically follows a structured hierarchy within the investment banking sector. Here’s a breakdown of the common career trajectory:

1. Summer Analyst

The journey begins as a Summer Analyst, an 8 to 10-week program typically offered to undergraduate students in their penultimate year. During this period, Summer Analysts are immersed in the day-to-day activities of the Global Investment Research division. Their responsibilities include conducting in-depth research, analyzing market data, and supporting senior analysts and associates. This role is designed to provide a comprehensive overview of the division and is often a stepping stone to a full-time position after graduation.

2. Full-Time Analyst

Upon successful completion of the summer program, many Summer Analysts transition to a full-time Analyst position. This role typically lasts 2 to 3 years and involves more substantial responsibilities, such as financial modeling, preparing client presentations, conducting detailed market research, and supporting the execution of transactions. Analysts play a crucial role in the team, working closely with associates and more senior members to deliver insightful research and analysis.

3. Associate

After gaining experience as an Analyst, professionals often move up to the Associate level, usually after 3 to 4 years. This promotion may require additional qualifications, such as an MBA, or significant relevant experience. Associates take on a leadership role, managing Analysts, leading projects, and interacting more directly with clients. They are responsible for ensuring the quality and accuracy of research and play a vital role in the success of the team’s deliverables.

4. Vice President (VP)

Following the Associate role, professionals can advance to the position of Vice President, generally after 3 to 5 years. VPs oversee the execution of major deals, manage key client relationships, and are deeply involved in mentoring and developing junior staff. This role involves a greater level of strategic thinking and decision-making, as VPs are expected to drive the team’s performance and contribute to the division’s broader goals.

5. Director/Senior Vice President (SVP):

The next step in the career ladder is the role of Director or Senior Vice President, typically achieved 2 to 4 years after becoming a VP. Directors/SVPs are responsible for making strategic decisions that impact the entire division, leading significant projects, and expanding the firm’s relationships with high-profile clients. They are seen as key leaders within the organization, guiding the division’s direction and ensuring the delivery of top-tier research and advisory services.

6. Managing Director (MD):

The pinnacle of the career path is the role of Managing Director, usually attained after 5 to 10 years as a Director. MDs are responsible for the overall business strategy of the Global Investment Research division, managing client relationships at the highest level, and driving significant revenue generation for the firm. They are the senior-most leaders, shaping the division’s future and representing Goldman Sachs at the highest echelons of the financial industry.

This structured path emphasizes merit-based advancement, with opportunities for professional development and leadership training provided by Goldman Sachs through programs like Goldman Sachs University (GSU).

6. Main Topics to Prepare for the Interview

To excel in your interview for the Summer Analyst role in GIR at Goldman Sachs, focus on the following topics:

- Understand the principles of financial analysis and modeling, including how to build and maintain financial models for specific companies and sectors.

- Be familiar with techniques for analyzing market share, macro trends, and cross-company data.

- Gain knowledge of market research methodologies, including how to compile, summarize, and analyze market-based data.

- Be prepared to discuss how you perform statistical analysis of economic data, fundamentals, and relevant correlations.

- Understand the basics of equity and fixed income research, including how to analyze securities and provide investment recommendations.

- Be prepared to discuss how these insights are used to inform client investment strategies.

- Demonstrate your ability to write clear and concise research reports, summarizing key findings and providing actionable insights.

- Be prepared to discuss how you communicate research findings to stakeholders, including global analyst teams and clients.

- Understand the importance of teamwork and collaboration in a global research environment, particularly in producing high-quality research.

- Be prepared to discuss how you manage relationships with key stakeholders to ensure alignment and accurate reporting.

7. Interview Process and Structure

Here is a summary of the interview process and structure for the Goldman Sachs Summer Analyst position, based on the provided search results:

Interview Process

1. Online Application

- Resume and cover letter submission

- Filling out personal information like contact details, education, languages, etc.

2. Video Interview (Hirevue)

- 3-6 behavioral questions

- 30 seconds prep time per question, 2 minutes to answer each

- 1 attempt per question

3. Superday (Final Round Interviews)

- 3-4 back-to-back interviews, mix of behavioral and technical questions

- Interviews typically last 30-45 minutes each

Interview Structure

1. Coding Round (Online Test)

- 1 hour 50 minutes, 4 sections:

- 2 medium coding questions

- Math and aptitude MCQs

- Coding MCQs

- 2 essay questions

- Around 40 students shortlisted from this round

2. Technical Interviews

- Introductory questions about the candidate's background and projects

Coding questions on topics like:

- Finding the next smaller palindrome

- Missing number in an array

- First missing positive number

- Minimum absolute difference in a BST

- Validating a Sudoku solution

- Data structures and algorithms questions

- DBMS and SQL questions

- OOP concepts

Behavioral Questions

- Why Goldman Sachs and the specific division?

- Discussing a current event or recent transaction of interest

- Situational and problem-solving questions

- Motivation for applying and fit with the role

The process involves a mix of online assessments, video interviews, and in-person superday interviews with a focus on both technical skills and behavioral fit. Candidates should prepare by practicing coding questions, reviewing their resume and projects, and researching the firm and role in depth.

8. Goldman Sachs GIR Summer Analyst Interview Questions

The Goldman Sachs GIR Summer Analyst interview will evaluate both your technical and behavioral competencies. You’ll encounter a mix of general, technical, behavioral, and problem-solving questions designed to assess your expertise and fit for the role.

General Questions

- Why do you want to work at Goldman Sachs, specifically in the GIR division?

- What do you know about the Global Investment Research division and its role within Goldman Sachs?

- How do you think your academic background prepares you for this internship?

- What are your career aspirations, and how does this role fit into them?

- Can you describe your understanding of the responsibilities of a Summer Analyst in the GIR division?

Technical/Functional Questions

- What are the key components of a financial model, and how do they interact?

- Can you explain the concept of equity valuation and the methods used?

- What is the significance of macroeconomic indicators in investment research?

- How would you assess the creditworthiness of a company?

- What recent market trends do you find interesting, and why?

Behavioral Questions

- Describe a time when you had to analyze a large amount of data. What was your approach?

- Tell me about a situation where you had to work with a difficult team member. How did you handle it?

- Give an example of a time you took the initiative on a project. What was the outcome?

- Describe a challenging problem you faced and how you resolved it.

- Tell us about a time when you had to adapt to a significant change. How did you manage it?

Role-Specific Questions

- What types of research reports do you think are most valuable to institutional investors?

- How do you stay updated on industry trends and developments relevant to GIR?

- Can you discuss a recent investment recommendation you found compelling? What made it stand out?

- What skills do you believe are essential for success in the Global Investment Research division?

- How would you approach building a sector analysis report?

Problem-Solving Questions

- If given a dataset on stock performance, how would you analyze it to make investment recommendations?

- Imagine you have conflicting data from two different sources. How would you resolve this issue?

- You are tasked with preparing a presentation on a new market opportunity. What steps would you take?

- How would you prioritize your tasks if you were given multiple research assignments with tight deadlines?

- If you discovered an error in a report just before a client meeting, what would you do?

9. Salary and Compensation

Understanding the compensation structure is essential when considering a role at Goldman Sachs. Here’s an overview:

- Base Salary: Competitive salary based on experience and location.

- Variable Pay: Performance-based bonuses and incentives may be offered based on individual and company performance.

- Benefits: Goldman Sachs offers a comprehensive benefits package, including health insurance, retirement plans, and opportunities for professional development.

10. Conclusion

Starting your career as a Summer Analyst in GIR at Goldman Sachs offers an excellent opportunity to work in a dynamic and innovative environment focused on delivering high-quality financial research to global clients. This role is ideal for finance professionals who are detail-oriented, analytical, and passionate about financial research. By thoroughly preparing and aligning your skills with Goldman Sachs' expectations, you can excel in the interview process and build a rewarding career in Global Investment Research.

Tips for Interview Success:

- Master Financial Analysis and Modeling Concepts: Ensure you’re proficient in financial analysis, modeling, and market research.

- Prepare for Case Studies: Practice case studies related to financial research to demonstrate your analytical skills and problem-solving abilities.

- Understand Goldman Sachs’ Culture: Align your career goals with Goldman Sachs’ values of integrity, teamwork, and client service.

- Be Professional and Confident: Display confidence in your knowledge and maintain professionalism throughout the interview process.

- Ask Insightful Questions: Show your genuine interest in the role by asking thoughtful questions about the team, projects, and career growth opportunities.

By following these guidelines, you'll be well-prepared to make a strong impression and secure a position as a Summer Analyst in GIR at Goldman Sachs. Good luck!